Previous Session Recap

Trading volume at PSX floor dropped by 35.17 million shares or 19.8% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43712.63, posted a day high of 43724.56 and a day low of 43416.45 during last trading session. The session suspended at 43441.18 with net change of -263.92 and net trading volume of 45.53 million shares. Daily trading volume of KSE100 listed companies dropped by 15.8 million shares or 25.76% on DoD basis.

Foreign Investors remained in net buying position of 0.56 million shares but net value of Foreign Inflow dropped by 1.82 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.23 and 0.46 million shares but Overseas Pakistanis remained in net buying position of 1.25 million shares. While on the other side Local Individuals, NBFCs and Mutual Funds remained in net buying positions of 4.21, 1.98 and 3.89 million shares respectively but Local Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 5.5, 1.31, 2.21 and 0.31 million shares respectively.

Analytical Review

Asian shares found relief on Thursday as fears about a global trade war amid U.S. President Donald Trump’s push to introduce protectionist tariffs were tempered by signs the move could include carve-outs for key partners. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.2 percent, led by gains in South Korean shares, which also benefited from signs of easing tensions between the two Koreas. Japan's Nikkei .N225 gained one percent. On Wall Street, the S&P 500 .SPX ended down just 0.05 percent at 2,726.8 after an initial loss of almost one percent, with tech shares being a major bright spot. They erased most losses as White House spokeswoman Sarah Sanders told a media briefing that the impending hefty U.S. tariffs on steel and aluminum imports could exclude Canada, Mexico and a clutch of other countries.

The government on Wednesday approved more than Rs93 billion worth of financing plan, mostly through loans, for the energy sector to avoid loadshedding and 6.1 million tonnes of procurement target for wheat season 2017-18. The decisions were taken at a meeting of the Economic Coordination Committee (ECC) of the Cabinet that also noted that there were no sellers for public sector sugar stocks at official rates as farmers suffered. The meeting was presided over by Prime Minister Shahid Khaqan Abbasi.

Lowers GDP growth projection to 5.6pc | Expects 5.5pc fiscal deficit, 4.8pc CAD Calls for greater exchange rate flexibility, strengthening fiscal discipline. The International Monetary Fund (IMF) has expressed concerns on the weakening of the macroeconomic situation , including a widening of external and fiscal imbalances, a decline in foreign exchange reserves, and increased risks to Pakistan’s economic and financial outlook and its medium term debt sustainability. “Pakistan’s near-term outlook for economic growth is broadly favorable. Real GDP is expected to grow by 5.6 percent in FY 2017/18, supported by improved power supply, investment related to the China-Pakistan Economic Corridor (CPEC), strong consumption growth, and ongoing recovery in agriculture. Inflation has remained contained,” the IMF stated after its Executive Board meeting on the first Post-Programme Monitoring Discussions with Pakistan. The government had projected the economy to grow at 6 percent during current fiscal year. However, the Fund projected 5.6 percent growth, which would be highest in last one decade. Similarly, the IMF has also observed that continued erosion of macroeconomic resilience could put this outlook at risk.

The National Economic Council on Wednesday approved increasing sanctioning powers of development fora of the Azad Jammu and Kashmir, the Gilgit-Baltistan and the Federally-Administrated Tribal Areas for projects by up to 400 per cent. The approval was given in a NEC meeting chaired by Prime Minister Shahid Khaqan Abbasi at the PM Office. Sanctioning limit for Development Working Party (DWP) of the three regions has been increased to Rs400 million, while the Development Committees (DC) would be authorised to sanction the development expenditure up to Rs1 billion. Previously, the sanctioning limit of the AJK's forum DWP was Rs100 million, of the GB DWP Rs200 million and that of the Fata DWP Rs200 million. The NEC increased the sanctioning limit of these three regions to Rs400 million. Similarly, the previous sanctioning limit of AJK DC was Rs400 million, of the GB DC Rs750 million, and that of the Fata DC Rs400 million. The NEC approved the limit to Rs1 billion.

The Executive Committee of the National Economic Council (ECNEC) Wednesday approved 8 development projects costing Rs80.13 billion. Prime Minister Shahid Khaqan Abbasi chaired meeting of the ECNEC at PM Office. The meeting approved the upgradation/extension of NTDC’s Telecommunication and SCADA System at a total rationalised cost of Rs11,638 million. Similarly, the ECNEC also gave approval for the establishment of 200-bed Center of Excellence for Obstetrics & Gynecology at Rawalpindi (revised) at a total rationalised cost of Rs 5,301.41 million. The committee also approved Southern Punjab Poverty Alleviation Project (SPPAP)-IFAD assisted (revised-II) at a rationalised cost of Rs 7,565.78 million.

Market seems to remain volatile during current trading session therefore its recommended to practice caution.

Technical Analysis

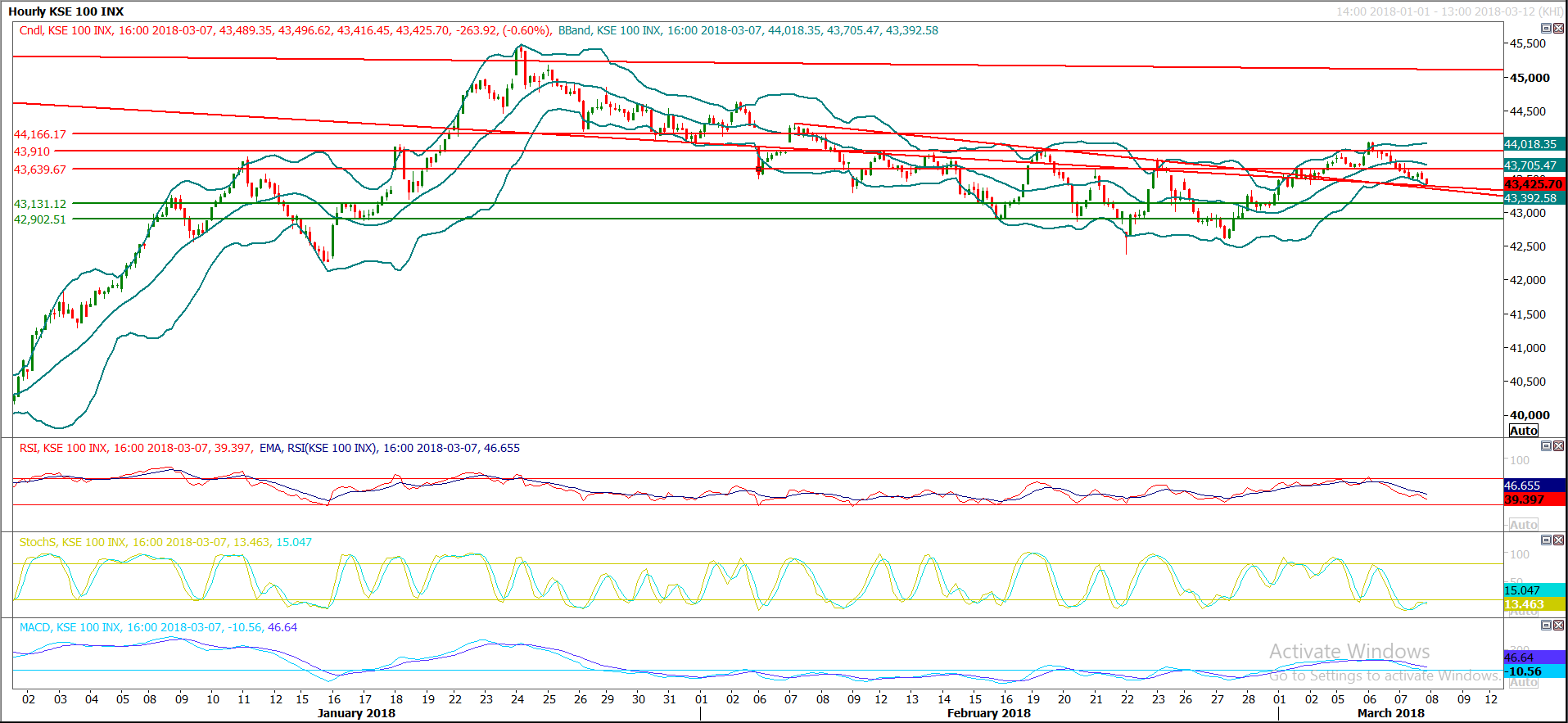

The Benchmark KSE100 Index have closed right at a long term supportive trend line therefore to continue its bearish momentum on daily basis it needs to opened with a negative gap below 43400 or have to close below that region on hourly chart. Breakout of 43400 would call for 43200 and 43130 points on intrday basis where index would find some ground at horizontal supportive regions. For current trading session index have resistant regions ahead at 43640, 43760 and 43910 points and these regions would try to react as strong resistance against any intrday bullish rallies. Hourly and Daily Stochastic and MAORSI are in bearish mode which indicates a continuity pattern in bearish direction towards 42900 points. Closing below 44400 on daily chart would change short term term trend to bearish therefore its recommended to sell on strength for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.