Previous Session Recap

Trading volume at PSX floor increased by 130.34 million shares or 49.78% on DoD basis, whereas the benchmark KSE100 index opened at 33,047.79, posted a day high of 33,850.96 and a day low of 32,947.22 points during last trading session while session suspended at 33,636.82 points with net change of 603.50 points and net trading volume of 247.15 million shares. Daily trading volume of KSE100 listed companies increased by 102.38 million shares or 70.72% on DoD basis.

Foreign Investors remained in net selling positions of 4.79 million shares but net value of Foreign Inflow dropped by 2.11 million US Dollars. Categorically, Foreign Individual & Overseas Pakistanis remained in net buying positions of 0.19 and 3.66 million shares but Foreign Corporate investors remained in net selling positions of 8.63 million shares. While on the other side Local Individuals and NBFCs remained in net buying positions of 28.19 and 2.88 million shares respectively but Local Companies, Banks, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 0.48, 11.74, 6.30, 3.55 and 5.45 million shares respectively.

Analytical Review

China joins Asian shares in cautious advance ahead of trade talks

Asian shares inched up on Tuesday, with Chinese shares making modest gains after a week-long holiday, though investors remained cautious over U.S.-China trade talks after President Donald Trump said a quick trade deal was unlikely. Japan’s Nikkei climbed 1.0% while MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.73%, led by gains in tech shares in South Korea and Taiwan. South Korea’s Samsung Electronics rose 1.2% after its profit guidance. The semiconductor firm said its third-quarter operating profit likely fell 56% on a downturn in global memory chip prices, but that was better than what analysts had anticipated. Taiwan’s stock index gained 0.7% to hit five-month highs while Hong Kong shares extended gains after the territory’s leader said she had no plans to use the emergency regulation ordinance to introduce other laws. Shanghai shares rose 0.3% after the week-long break though gains were led mainly by defensive shares ahead of the crucial trade talks.

Fitch downgrades Aramco

Fitch on Monday downgraded Saudi Aramco by one notch after attacks last month on two production facilities, putting the rating of the state-owned oil giant at par with the one of Saudi Arabia, which the agency downgraded on Sept 30. Aramco the world’s largest oil company and the most profitable obtained its first credit rating of A+ by Fitch in April ahead of its inaugural public bond issue. Fitch said at the time that the company had a higher “standalone credit profile” equivalent to AA+’, but that its rating was “capped by that of Saudi Arabia in view of strong linkage between the state and the sovereign”. The downgrade by one notch, from A+ to A, but a stable outlook followed the Sept 14 attacks on Aramco’s oil installations, Fitch said, adding the “downgrade also took into account rising geopolitical tensions in the region, but also the country’s continued fiscal deficit, among other factors”.

Domestic debt up 3.7pc in July-August

The government’s domestic debt grew by 3.68 per cent in the first two months of this fiscal year while external borrowing decreased by 2.8pc during the period. According to data released by the State Bank of Pakistan on Monday, the government’s domestic debt increased by Rs764 billion to Rs21.495 trillion in August, up from Rs20.731tr as of June end. Meanwhile, the external debt fell by Rs310bn to Rs10.745tr in August, as compared to Rs11.055tr by June. The report also indicates that the central government’s collective debts (domestic plus external) rose by a cumulative Rs454bn to Rs32.24tr. Details suggest that the government’ move against corruption also affected the prize bonds markets as measures to crack down on black money decreased prize bonds debt by Rs140.8bn to Rs753.1bn in August, from Rs893.9bn.

Raabta brings experts to explore regional stability for economic prosperity

Serena Hotels hosted a panel discussion under its Public Diplomacy Initiative ‘Raabta’ on ‘Enterprising Peace – Regional Stability for Economic Prosperity’. The panel of experts, curated by Ms. Sidra Iqbal, a prominent broadcast journalist, featured Syed Shabbar Zaidi, Chairman FBR, Dr. Prof. Khalida Ghous, Human Rights and International Relations Activist, Fahd Husain, senior journalist and Ambassador Ali Sarwar Naqvi, Executive Director of the Center for International Strategic Studies (CISS). Illango Patchamuthu, World Bank’s Country Director for Pakistan was the keynote speaker. The discussion revolved around regions and states that are not necessarily in overt conflict, but that are institutionally and economically weak and vulnerable to international threats and instability.

ADB approves additional $200m loan for BISP

The Asian Development Bank (ADB) has approved a $200 million loan as additional financing to help support the government of Pakistan’s flagship social protection programme, the Benazir Income Support Programme (BISP). The BISP supported more than 5 million eligible families across the country through over $3.6 billion in total cash transfers disbursed so far. The incumbent government had brought the BISP programme under the umbrella of ‘Ehsaas Programme’ which was launched by Prime Minister Imran Khan in March this year. The objectives of Ehsaas programme are reducing inequality, investing in human resource, and to lift lagging districts.

Asian shares inched up on Tuesday, with Chinese shares making modest gains after a week-long holiday, though investors remained cautious over U.S.-China trade talks after President Donald Trump said a quick trade deal was unlikely. Japan’s Nikkei climbed 1.0% while MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.73%, led by gains in tech shares in South Korea and Taiwan. South Korea’s Samsung Electronics rose 1.2% after its profit guidance. The semiconductor firm said its third-quarter operating profit likely fell 56% on a downturn in global memory chip prices, but that was better than what analysts had anticipated. Taiwan’s stock index gained 0.7% to hit five-month highs while Hong Kong shares extended gains after the territory’s leader said she had no plans to use the emergency regulation ordinance to introduce other laws. Shanghai shares rose 0.3% after the week-long break though gains were led mainly by defensive shares ahead of the crucial trade talks.

Fitch on Monday downgraded Saudi Aramco by one notch after attacks last month on two production facilities, putting the rating of the state-owned oil giant at par with the one of Saudi Arabia, which the agency downgraded on Sept 30. Aramco the world’s largest oil company and the most profitable obtained its first credit rating of A+ by Fitch in April ahead of its inaugural public bond issue. Fitch said at the time that the company had a higher “standalone credit profile” equivalent to AA+’, but that its rating was “capped by that of Saudi Arabia in view of strong linkage between the state and the sovereign”. The downgrade by one notch, from A+ to A, but a stable outlook followed the Sept 14 attacks on Aramco’s oil installations, Fitch said, adding the “downgrade also took into account rising geopolitical tensions in the region, but also the country’s continued fiscal deficit, among other factors”.

The government’s domestic debt grew by 3.68 per cent in the first two months of this fiscal year while external borrowing decreased by 2.8pc during the period. According to data released by the State Bank of Pakistan on Monday, the government’s domestic debt increased by Rs764 billion to Rs21.495 trillion in August, up from Rs20.731tr as of June end. Meanwhile, the external debt fell by Rs310bn to Rs10.745tr in August, as compared to Rs11.055tr by June. The report also indicates that the central government’s collective debts (domestic plus external) rose by a cumulative Rs454bn to Rs32.24tr. Details suggest that the government’ move against corruption also affected the prize bonds markets as measures to crack down on black money decreased prize bonds debt by Rs140.8bn to Rs753.1bn in August, from Rs893.9bn.

Serena Hotels hosted a panel discussion under its Public Diplomacy Initiative ‘Raabta’ on ‘Enterprising Peace – Regional Stability for Economic Prosperity’. The panel of experts, curated by Ms. Sidra Iqbal, a prominent broadcast journalist, featured Syed Shabbar Zaidi, Chairman FBR, Dr. Prof. Khalida Ghous, Human Rights and International Relations Activist, Fahd Husain, senior journalist and Ambassador Ali Sarwar Naqvi, Executive Director of the Center for International Strategic Studies (CISS). Illango Patchamuthu, World Bank’s Country Director for Pakistan was the keynote speaker. The discussion revolved around regions and states that are not necessarily in overt conflict, but that are institutionally and economically weak and vulnerable to international threats and instability.

The Asian Development Bank (ADB) has approved a $200 million loan as additional financing to help support the government of Pakistan’s flagship social protection programme, the Benazir Income Support Programme (BISP). The BISP supported more than 5 million eligible families across the country through over $3.6 billion in total cash transfers disbursed so far. The incumbent government had brought the BISP programme under the umbrella of ‘Ehsaas Programme’ which was launched by Prime Minister Imran Khan in March this year. The objectives of Ehsaas programme are reducing inequality, investing in human resource, and to lift lagging districts.

Market is expected to remain volatile during current trading session.

Technical Analysis

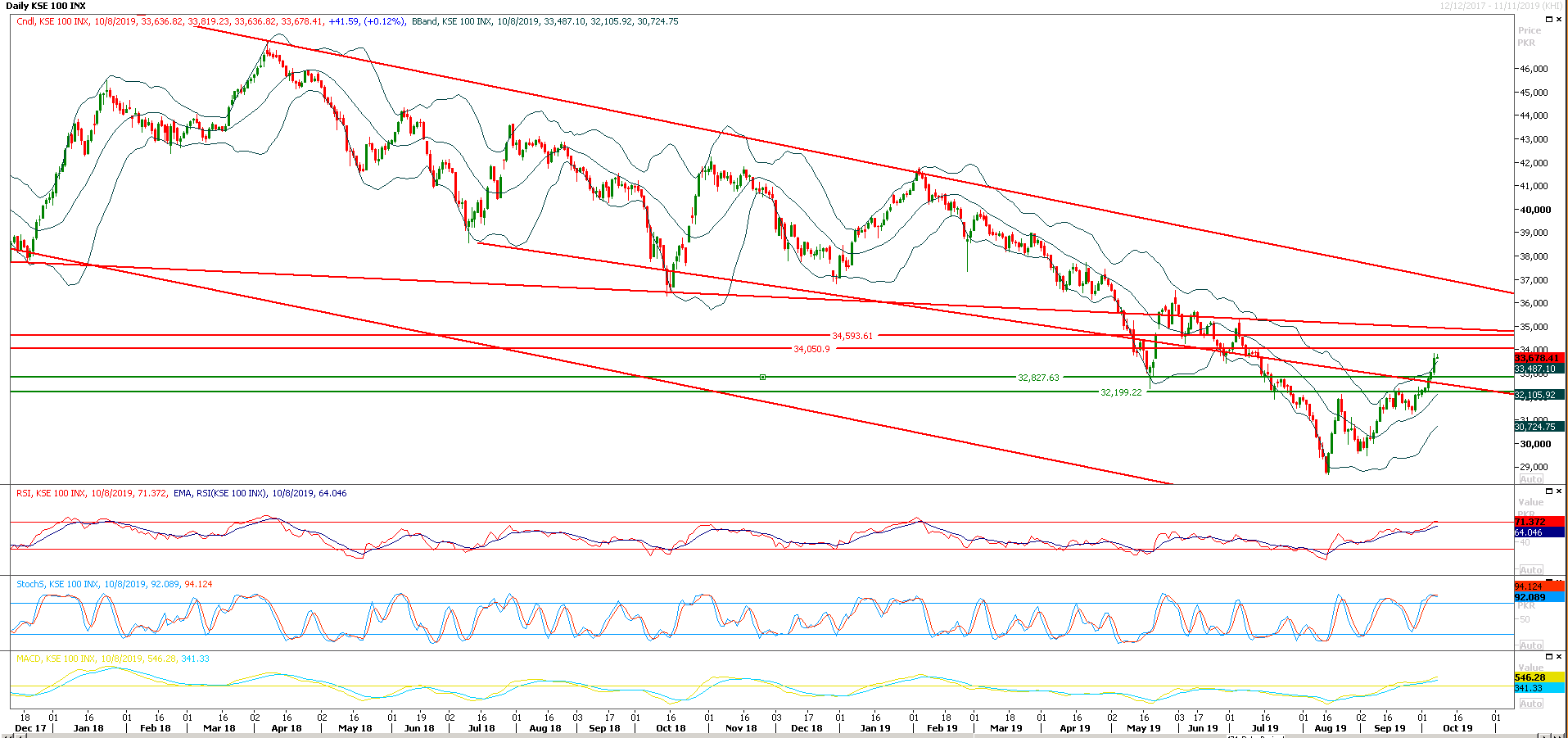

The Benchmark KSE100 index have succeed in penetration above its major resistant trend line during last trading session and it's expected that index would try to retest said trend line during current trading session by taking a dip and if it would succeed in maintaining above this trend line then index would continue its bullish momentum towards 34,000 and 34,500 points. But penetration below said region even on hourly chart will call for a trend change which may lead index towards 32,800 points and then 32,500 points. It's recommended to post trailing stop loss on long positions and practice caution or stay side line until index succeed in either penetration below 32,700 points or above 34,000 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.