Previous Session Recap

Trading volume at PSX floor dropped by 0.49 million shares or 0.33%, DoD basis, whereas, the benchmark KSE100 Index opened at 41346.46, posted a day high of 41477.84 and a day low of 40686.09 during the last trading session. The session suspended at 40958.65 with a net change of -431.34(-1.05%) points and net trading volume of 77.79 million shares. Daily trading volume of KSE100 listed companies increased by 1.44 million shares or 1.89%, DoD basis.

Foreign Investors remained in a net buying position of 1.17 million shares and a net value of Foreign Inflow increased by 0.97 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.12 and 2.99 million shares but Foreign Corporate investors remained in the net selling position of 1.94 million shares.On the other side Local Individuals and Companies remained in the net buying position of 3.95 and 3.7 million shares but Local Banks, Mutual Funds and Brokers remained in the net selling positions of 0.16, 4.26 and 3.74 million shares respectively.

Analytical Review

Asian shares edged up on Friday as investors kept a wary eye on another U.S. storm, while the dollar skidded after European Central Bank chief Mario Draghi suggested the bank may begin tapering its massive stimulus program this autumn. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.1 percent, but was still down 0.2 percent for the week. Japan's Nikkei stock index .N225 was pressured by a stronger yen and slipped 0.5 percent, losing 2 percent for the week. Wall Street ended little changed on Thursday, as investors continued to tracking Hurricane Irma, which was bearing down on Florida on the heels of devastation in Texas caused by Hurricane Harvey.

United States (US) banking regulators slapped a $225 million fine and Habib Bank Limited (HBL) to shutter its New York office, for repeatedly failing to heed concerns over possible terrorist financing and money laundering, officials said Thursday. HBL, Pakistan's largest private bank, neglected to watch for compliance problems and red flags on transactions that potentially could have promoted terrorism, money laundering or other illicit ends, New York banking officials said. The state's Department of Financial Services, which regulates foreign banks, had initially proposed a $629.6m penalty. HBL has operated in the US since 1978, and in 2006 was ordered to tighten its oversight of potentially illegal transactions but failed to comply.

While expressing reservations over the proposed amendments in NEPRA act, the National Electric Power Regulatory Authority (Nepra) has said that after one year finally the draft has been shared with the regulator. “We have received the draft amendment after one year and as a regulator and custodian the government is required to incorporate their views in the amendments,” said Nepra Chairman Tariq Sadozai while briefing the National Assembly standing committee on Energy. The Nepra chairman said that they have reservations and are reviewing the draft amendments which will enable them to add their input into it. “Grant us some time as we have yesterday received the draft and will inform the committee about our convergence and divergence points,” he added. The committee, therefore, deferred both the bills till its next meeting for further discussion. The committee has directed that Ministry of Power may hold a meeting with concerned stake holders to remove lacunas in the purposed legislation if any, and report back to the committee within one week so that the committee could consider them accordingly.

The Asian Development Bank (ADB) has recognised two Pakistani banks among 20 others in its third annual Trade Finance Programme (TFP) awards. The TFP awards recognised Pakistani Bank "Bank Al Habib Limited" among 17 other leading partner banks from 17 countries. In addition, TFP introduced new award categories, including Trade Deal of the Year, Best SME Trade Deal, Most Progressive Bank on Gender Strategy, and Supply Chain Finance Partner of the Year. The Best SME Trade Deal award was given to another Pakistani bank "Habib Metropolitan Bank Limited". "Without our partner banks, ADB's Trade Finance Programme would not close over $3 billion a year in trade finance market gaps," said Steven Beck, Head of Trade Finance at ADB. "These awards are a great opportunity to recognise and thank our partners for the work they do to provide finance to companies, which helps create growth and jobs".

As like missing tax collection target, the government had also missed the non-tax revenue collection target during fiscal year 2016-17 mainly due to the non-reimbursement of Coalition Support Fund (CSF) from the United States. The government had budgeted non-tax revenue collection target at Rs959.5 billion for the previous year. However, the government had generated Rs901.6 billion under non-tax revenue collection making a shortfall of around Rs58 billion. Similarly, the Federal Board of Revenue (FBR) had also missed the tax collection target by Rs260 billion as it collected Rs3,362 billion during the year 2016-17.

Today ATRL. HBL , PSO and TRG may lead the index in the positive direction.

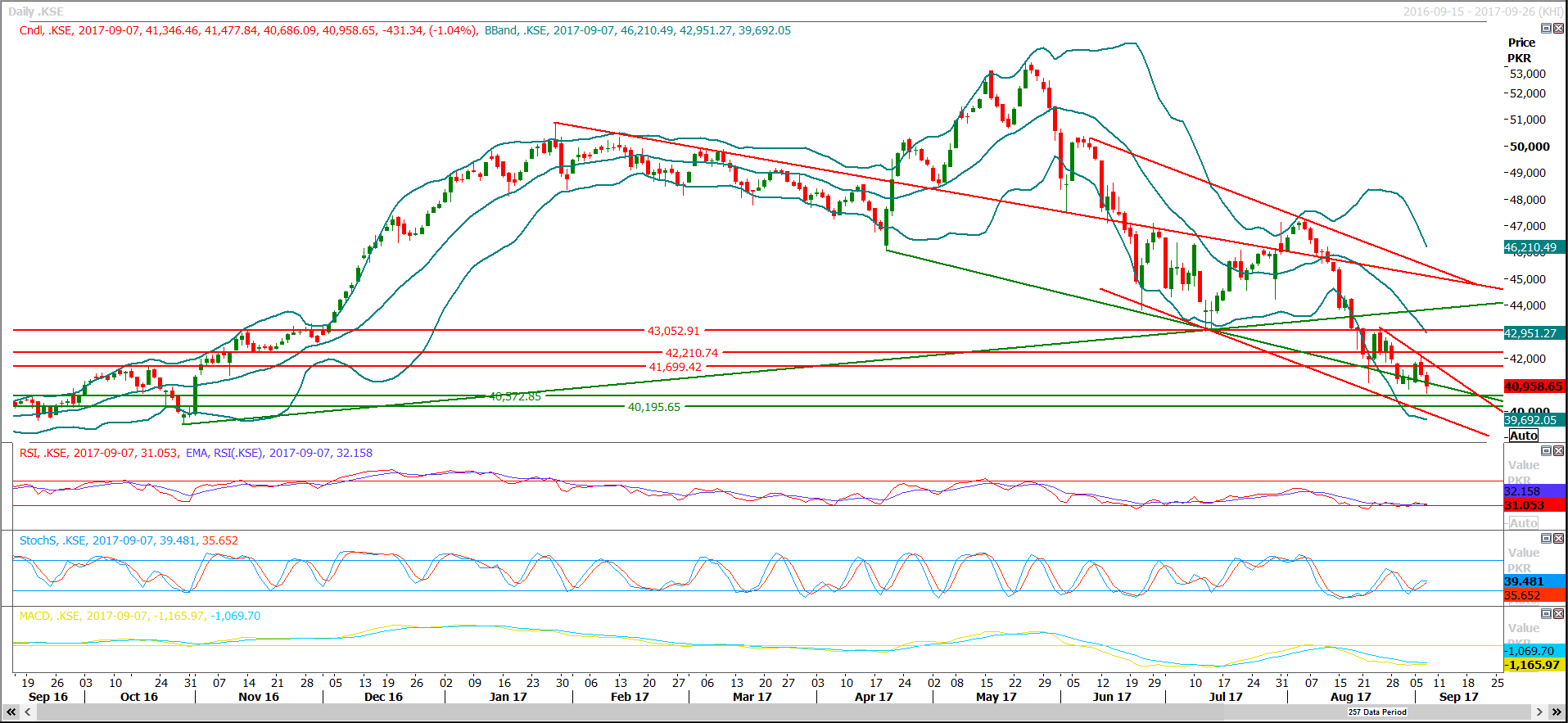

Technical Analysis

The Benchmark KSE100 Index is ready for a pull back for formation of fourth wave of its bearish Elliot wave and it may bounce back at anytime around 40500 or 40200, as it have supporitve regions ahead at these levels. Stochastic and MAORSI is attempting to generate a bullish crossover on hourly chart which is indicating a reversal pattern on intraday basis but daily chart might confirm its reversal once it closes above 41700 . As of now buying on dips with a strict stop loss of 40500 or 40200 is recommended. As per portfolio size, this reversal might continue till 42200, 43000 and 43700 for a correction of its current bearish rally. Index may remain bearish until and unless it closes above 44000. This Elliot Wave may lead the index towards 38500 and 36000 points if completed.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.