Previous Session Recap

Trading volume at PSX floor increased by 8.13 million shares or 4.71% on DoD basis, whereas the benchmark KSE100 index opened at 31,231.55, posted a day high of 31,238.35 and a day low of 30,775.45 points during last trading session while session suspended at 30,971.27 points with net change of 260.28 points and net trading volume of 153.09 million shares. Daily trading volume of KSE100 listed companies also increased by 10.44 million shares or 7.32% on DoD basis.

Foreign Investors remained in net long positions of 1.23 million shares but value of Foreign Inflow dropped by 0.19 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 0.69 million shares but Overseas Pakistani remained in net long positions of 1.92 million shares respectively. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 0.33, 2.99, 0.11,2.43 and 2.85 million shares but Local Individuals and Brokers remained in net selling positions of 2.73 and 3.16 million shares respectively.

Analytical Review

Asian stocks gain on hopes pandemic is approaching peak

Asian shares rose on Thursday on hopes the COVID-19 pandemic is nearing a peak and that governments would roll out more stimulus measures, while expectations of an oil production cut agreement bolstered crude prices. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.6%, following a strong Wall Street close. Shares in China, where the novel coronavirus first emerged late last year, rose 0.54%. Australian shares were up 1.52%. Oil prices extended gains on hopes major producers will cut output at a meeting later in the day in response to a collapse in global oil demand. New York Governor Andrew Cuomo said the state’s efforts at social distancing were working in getting the virus under control in one of the biggest hot spots in the United States.

No deal with govt on tax refunds for pay rolls, say industry leaders

Payments of tax refunds have gathered pace since the lockdowns began, picking up steam after the prime minister’s announcement of a relief package to help industry survive without resorting to large scale layoffs. Tax officials say they are on track to complete the disbursement of Rs100 billion by the end of April under the PM package that promised these refunds against a commitment that recipients of this money will use it to run their payrolls and not lay any of their workers off during the shutdowns.

Yields fall, bids rise in T-bill auction

The government on Wednesday raised Rs495 billion through the auction of treasury bills as cut-off yields were slashed by 122 basis points for 12-month papers. The government remained within its auction target of Rs500bn despite attracting bids worth Rs1.914 trillion. Since the foreign investment has almost stopped, majority of the bids were made by domestic investors and local banks. The banks have large liquidity as the lockdown in the country due to COVID-19 pandemic has reduced borrowing needs of the trade and industry sectors. The government raised the highest amount Rs160bn in 12-month papers with cutt-off yield for the tenor falling by 122bps. The rate of return for these papers fell to 9.65 per cent.

Global trade will plunge by a third in 2020: WTO

Global trade could plummet by a third this year due to the coronavirus pandemic, the World Trade Organisation said on Wednesday, warning the deepest recession “of our lifetimes” could be on the horizon. “Covid-19 has completely upended the global economy and with it international trade,” WTO chief Roberto Azevedo told reporters in a virtual briefing from Geneva. The global trade body was projecting that “trade in 2020 will fall steeply in every region of the world, and basically across all sectors of the economy,” he said.

Pakistan’s inflation rate to drop to 8.3pc next year, predicts ADB

The Asian Development Bank has projected that Pakistan’s inflation rate would slow down to 8.3 percent in the fiscal year 2020-21. “Inflation is forecast to decelerate to 8.3% in FY2021 with the central bank expected to take further policy action to both manage inflation and boost economic activity,” the ADB said in its latest annual flagship economic publication, Asian Development Outlook (ADO) 2020. It said inflation is projected to accelerate to 11.5 percent in FY2020, reflecting a sharp rise in food prices in the first part of the fiscal year and a 9.8 percent drop in the value of the local currency against the US dollar in the first seven months of FY2020.

Asian shares rose on Thursday on hopes the COVID-19 pandemic is nearing a peak and that governments would roll out more stimulus measures, while expectations of an oil production cut agreement bolstered crude prices. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.6%, following a strong Wall Street close. Shares in China, where the novel coronavirus first emerged late last year, rose 0.54%. Australian shares were up 1.52%. Oil prices extended gains on hopes major producers will cut output at a meeting later in the day in response to a collapse in global oil demand. New York Governor Andrew Cuomo said the state’s efforts at social distancing were working in getting the virus under control in one of the biggest hot spots in the United States.

Payments of tax refunds have gathered pace since the lockdowns began, picking up steam after the prime minister’s announcement of a relief package to help industry survive without resorting to large scale layoffs. Tax officials say they are on track to complete the disbursement of Rs100 billion by the end of April under the PM package that promised these refunds against a commitment that recipients of this money will use it to run their payrolls and not lay any of their workers off during the shutdowns.

The government on Wednesday raised Rs495 billion through the auction of treasury bills as cut-off yields were slashed by 122 basis points for 12-month papers. The government remained within its auction target of Rs500bn despite attracting bids worth Rs1.914 trillion. Since the foreign investment has almost stopped, majority of the bids were made by domestic investors and local banks. The banks have large liquidity as the lockdown in the country due to COVID-19 pandemic has reduced borrowing needs of the trade and industry sectors. The government raised the highest amount Rs160bn in 12-month papers with cutt-off yield for the tenor falling by 122bps. The rate of return for these papers fell to 9.65 per cent.

Global trade could plummet by a third this year due to the coronavirus pandemic, the World Trade Organisation said on Wednesday, warning the deepest recession “of our lifetimes” could be on the horizon. “Covid-19 has completely upended the global economy and with it international trade,” WTO chief Roberto Azevedo told reporters in a virtual briefing from Geneva. The global trade body was projecting that “trade in 2020 will fall steeply in every region of the world, and basically across all sectors of the economy,” he said.

The Asian Development Bank has projected that Pakistan’s inflation rate would slow down to 8.3 percent in the fiscal year 2020-21. “Inflation is forecast to decelerate to 8.3% in FY2021 with the central bank expected to take further policy action to both manage inflation and boost economic activity,” the ADB said in its latest annual flagship economic publication, Asian Development Outlook (ADO) 2020. It said inflation is projected to accelerate to 11.5 percent in FY2020, reflecting a sharp rise in food prices in the first part of the fiscal year and a 9.8 percent drop in the value of the local currency against the US dollar in the first seven months of FY2020.

Market is expected to remain volatile during current trading session.

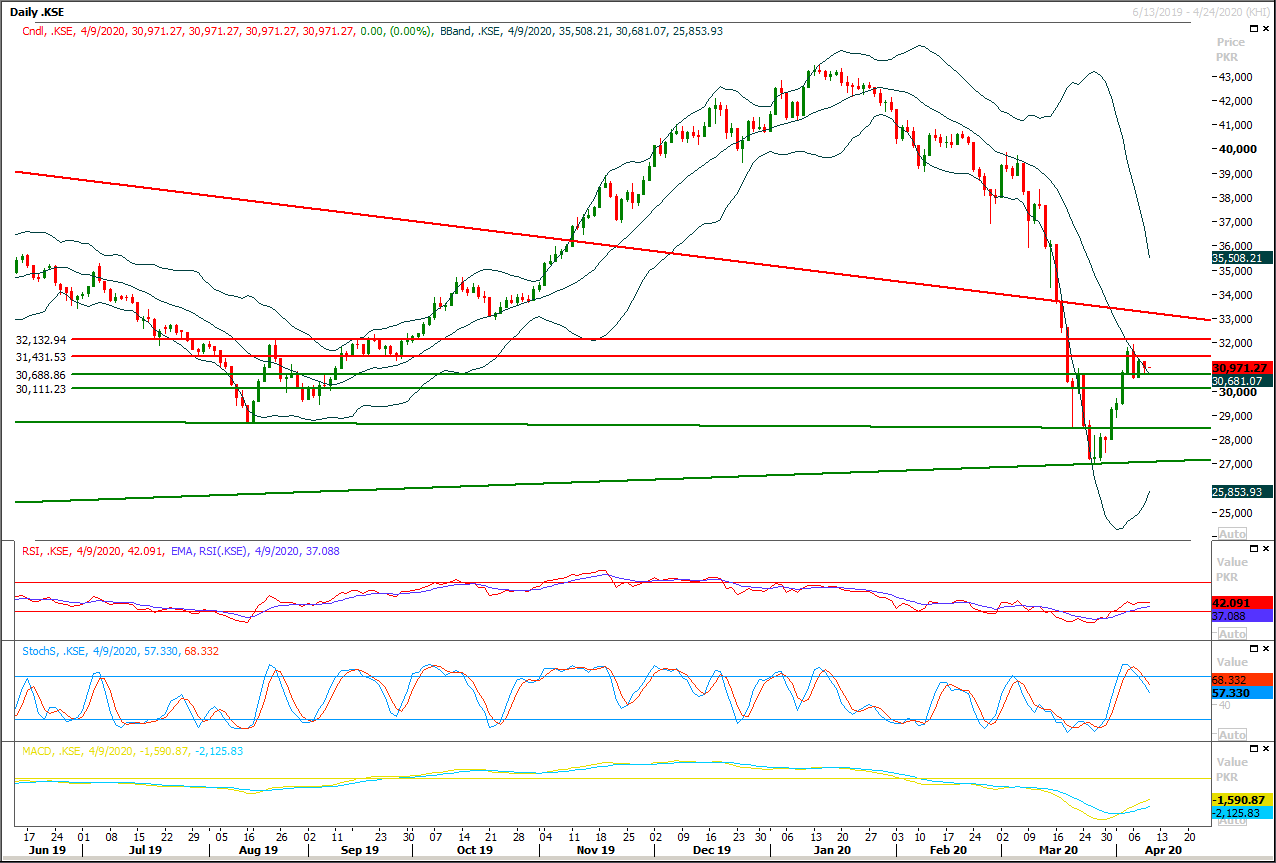

Technical Analysis

The Benchmark KSE100 Index is being capped by 38% correction of its last bearish rally and it's not becoming able to give a breakout above 32,000 points since last three trading session, but at day end yesterday index have generated a hope for bulls by creating a piercing line formation on daily chart but resistant regions are still intact and these would try to cap any bullish sentiment at 31500 points and 32,000 points. Index would remain bearish on short term basis until it would not succeed in closing above 32,500 points. Meanwhile bullish sentiment generated by weekly engulfing pattern would start losing strength if index would not succeed in closing above 32,500 points on weekly closing basis. Meanwhile on supportive side index would try to find some ground at 30,700 points in case of bearish pressure and breakout below that region would call for a sharp bearish rally towards 30,000 points and 29,500points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.