Previous Session Recap

Trading volume at PSX floor dropped by 90.98 million shares or 17.91% on DoD basis, whereas the benchmark KSE100 index opened at 40,641.10, posted a day high of 40,987.76 and a day low of 40,595.96 points during last trading session while session suspended at 40,732.25 points with net change of 91.15 points and net trading volume of 268.60 million shares. Daily trading volume of KSE100 listed companies dropped by 58.63 million shares or 17.92% on DoD basis.

Foreign Investors remained in net selling positions of 0.59 million shares and value of Foreign Inflow dropped by 0.36 million US Dollars. Categorically, Foreign Individual and Overseas Pakistanis remained in net selling positions of 0.17 and 1.04 million shares but Foreign Corporate Investors remained in net buying positions of 0.63 million shares. While on the other side Local Companies, Mutual Fund and Insurance Companies remained in net buying positions of 18.99, 18.00 and 5.06 million shares but Local Companies, Banks, NBFCs and Brokers remained in net selling positions of 19.63, 7.76, 3.26, 0.40 and 11.90 million shares respectively.

Analytical Review

Asian shares buoyed by Wall St rally, but China worry caps gains

Asian stocks edged up on Monday, catching some of Wall Street’s momentum after surprisingly strong U.S. jobs data although regional gains were capped by concerns about China’s economic slowdown due to the prolonged Sino-U.S. trade war. Japan's benchmark Nikkei .N225 added 0.4% while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.3%, with Australian stocks and South Korea's KOSPI .KS11 up 0.4% and 0.3%, respectively. China's Shanghai Composite .SSEC stood flat and Hong Kong's Hang Seng .HSI rose 0.2%. Wall Street rose to near record highs on Friday on the strong jobs data and some signs of optimism about the U.S.-China trade talks, with the benchmark S&P 500 .SPX closing within 0.2% of its peak set in late November.

Provinces forego uplift plans, return Rs202bn to Centre

The four provinces jointly provided a whopping cash surplus of Rs202 billion to the Centre during the first quarter (July-September) of the current fiscal year to help meet its fiscal targets committed to the International Monetary Fund (IMF). This means the provinces did not utilise more than one-fourth (25 per cent) of the funds for the welfare of their citizens made available to them under their total revenue share out of the federal divisible pool. In doing so, the provinces over-performed in extending the cash surplus to the federal government as their cumulative refund to the Centre amounted to Rs202bn (almost 48pc) in a quarter against an annual target of Rs423bn set for the financial year 2019-20. Fiscal data released by the finance ministry showed that the cumulative revenues available to the four provinces in the first quarter amounted to Rs791bn. This included their joint share of Rs612.5bn out of federal revenues and about Rs104.5bn worth of provincial taxes.

Traders hail PHC order to probe BRT

The United Business Group, a group of businessmen, has hailed the Peshawar High Court’s verdict, directing the FIA to conduct probe into the alleged corruption in the BRT project within 45 days. The group’s leader and former senator, Ilyas Ahmad Bilour,while talking to mediapersons here on Sunday, said the people of Peshawar, particularly the business community, had suffered heavily due to the BRT project, but added that the high court would hopefully provide them with justice. Mr Bilour alleged that the PTI government had ruined the Peshawar city by launching the project, and said it would take decades to restore the city’s past beauty. The businessman said the government’s move to challenge the decision of the high court in the Supreme Court had proved that it was in a bid to hide its failures and corruption.

Govt releases Rs297b for development projects

The federal government has so far released Rs297.643 billion for various ongoing and new social sector uplift projects under its Public Sector Development Programme (PSDP) 2019-20, as against the total allocation of Rs701 billion. Under its development programme, the government has released an amount of Rs135.113 billion for federal ministries, Rs100.56 billion for corporations and Rs21.52 billion for special areas, according to a latest data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs26.78 billion for security enhancement in the country for which the government had allocated Rs 32.5 billion during the year 2019-20. An amount of Rs12 billion has also been released for the merged areas of erstwhile Federally Administered Tribal Areas (FATA) under the government's 10 years development programme.

Cost of Tarbela 4th hydropower project increases by 47 percent

The cost of Tarbela 4th hydropower project has increased by 47.09 percent from original Rs83.6 billion to Rs123 billion mainly due to delay in completion, increased scope of work and rupee value depreciation. The source said that the revised PC-I of the project was referred by Central Development Working Party to ECNEC with the increased cost of Rs39.38 billion, official source told The Nation here Sunday. The Original PC-I of Tarbela 4th hydropower project had expired in January 2017, however the revision in cost and scope of work was carried out without prior approval of CDWP/ ECNEC, said the source. Tarbela 4th project was approved in August 2012 and was due for completion in 2017, however it was delayed and will now be completed next year, said the source. The source said that revised Coordinated Construction Schedule (RCCS) was approved only by WAPDA and implemented without the approval of CDWP/ ECNEC. Full payment was made for raised intake under Variation Order-02 ($ 48 Million). The task was due for completion In June 2017 but is still ongoing.

Asian stocks edged up on Monday, catching some of Wall Street’s momentum after surprisingly strong U.S. jobs data although regional gains were capped by concerns about China’s economic slowdown due to the prolonged Sino-U.S. trade war. Japan's benchmark Nikkei .N225 added 0.4% while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.3%, with Australian stocks and South Korea's KOSPI .KS11 up 0.4% and 0.3%, respectively. China's Shanghai Composite .SSEC stood flat and Hong Kong's Hang Seng .HSI rose 0.2%. Wall Street rose to near record highs on Friday on the strong jobs data and some signs of optimism about the U.S.-China trade talks, with the benchmark S&P 500 .SPX closing within 0.2% of its peak set in late November.

The four provinces jointly provided a whopping cash surplus of Rs202 billion to the Centre during the first quarter (July-September) of the current fiscal year to help meet its fiscal targets committed to the International Monetary Fund (IMF). This means the provinces did not utilise more than one-fourth (25 per cent) of the funds for the welfare of their citizens made available to them under their total revenue share out of the federal divisible pool. In doing so, the provinces over-performed in extending the cash surplus to the federal government as their cumulative refund to the Centre amounted to Rs202bn (almost 48pc) in a quarter against an annual target of Rs423bn set for the financial year 2019-20. Fiscal data released by the finance ministry showed that the cumulative revenues available to the four provinces in the first quarter amounted to Rs791bn. This included their joint share of Rs612.5bn out of federal revenues and about Rs104.5bn worth of provincial taxes.

The United Business Group, a group of businessmen, has hailed the Peshawar High Court’s verdict, directing the FIA to conduct probe into the alleged corruption in the BRT project within 45 days. The group’s leader and former senator, Ilyas Ahmad Bilour,while talking to mediapersons here on Sunday, said the people of Peshawar, particularly the business community, had suffered heavily due to the BRT project, but added that the high court would hopefully provide them with justice. Mr Bilour alleged that the PTI government had ruined the Peshawar city by launching the project, and said it would take decades to restore the city’s past beauty. The businessman said the government’s move to challenge the decision of the high court in the Supreme Court had proved that it was in a bid to hide its failures and corruption.

The federal government has so far released Rs297.643 billion for various ongoing and new social sector uplift projects under its Public Sector Development Programme (PSDP) 2019-20, as against the total allocation of Rs701 billion. Under its development programme, the government has released an amount of Rs135.113 billion for federal ministries, Rs100.56 billion for corporations and Rs21.52 billion for special areas, according to a latest data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs26.78 billion for security enhancement in the country for which the government had allocated Rs 32.5 billion during the year 2019-20. An amount of Rs12 billion has also been released for the merged areas of erstwhile Federally Administered Tribal Areas (FATA) under the government's 10 years development programme.

The cost of Tarbela 4th hydropower project has increased by 47.09 percent from original Rs83.6 billion to Rs123 billion mainly due to delay in completion, increased scope of work and rupee value depreciation. The source said that the revised PC-I of the project was referred by Central Development Working Party to ECNEC with the increased cost of Rs39.38 billion, official source told The Nation here Sunday. The Original PC-I of Tarbela 4th hydropower project had expired in January 2017, however the revision in cost and scope of work was carried out without prior approval of CDWP/ ECNEC, said the source. Tarbela 4th project was approved in August 2012 and was due for completion in 2017, however it was delayed and will now be completed next year, said the source. The source said that revised Coordinated Construction Schedule (RCCS) was approved only by WAPDA and implemented without the approval of CDWP/ ECNEC. Full payment was made for raised intake under Variation Order-02 ($ 48 Million). The task was due for completion In June 2017 but is still ongoing.

Market is expected to remain volatile during current trading session.

Technical Analysis

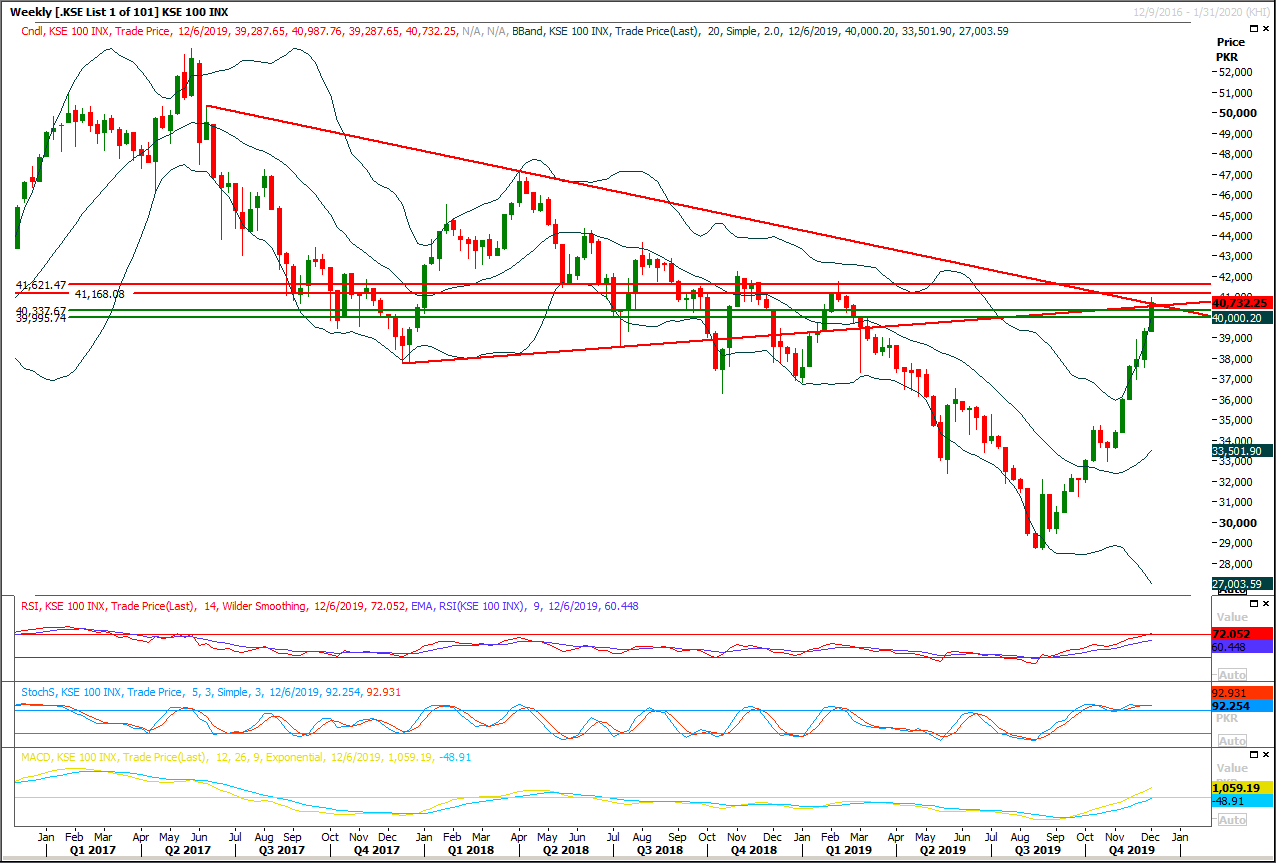

The Benchmark KSE100 index is not becoming able to close above a descending trend line on weekly chart since start of this week and it's expected that index would face some pressure during current trading session if it would not succeed in opening with a positive gap above 40,760 points during current trading session. Hourly momentum indicators have changed their direction towards bearish side and it's expected that index would face some pressure towards 40,350 points and if it would succeed in finding some ground there then it could bounce back but penetration below that region would call for 40,260 points and closing at that region would impact index very seriously and it would become difficult for index to breakout 40,800 or 41,200 points. But bounce back from supportive region would push index towards its resistant regions. It's recommended to practice caution while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.