Previous Session Recap

Trading volume at PSX floor dropped by 23.97 million shares or 8.88% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44079.12, posted a day high of 44151.54 and a day low of 43629.82 during last trading session. The session suspended at 43679.87 with net change of -416.62 and net trading volume of 96.62 million shares. Daily trading volume of KSE100 listed companies dropped by 12.3 million shares or 11.29% on DoD basis.

Foreign Investors remained in net selling position of 7.45 million shares and net value of Foreign Inflow dropped by 2.47 million US Dollars. Categroically, Foreign Corporate and Overseas Pakistani Investors remained in net net selling positions of 5.19 and 2.28 million shares respectively. While on the other side Local Individuals and Insurance Companies remained in net buying positions of 8.32 and 5.31 million shares but Local Companies, Banks, NBFCs, Mutual Funds and Brokers remained in net selling positions of 2.15, 3.25, 0.11, 0.87 and 1.89 million shares respectively.

Analytical Review

Asian stocks tumbled to two-month lows on Friday after Wall Street shares suffered yet another big slide in the face of rapidly-rising bond yields, with perceived havens such as the yen and Swiss franc in demand amid the turmoil. Japan’s Nikkei sagged 3.3 percent, en route for a weekly loss of 8.9 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 2.3 percent to a two-month low. The index, which had hit a record high on Jan. 29, was on track for its sixth straight day of losses and stood to lose about 7.7 percent on the week. Australian shares lost 1.15 percent and South Korea’s KOSPI fell 1.7 percent. Hong Kong's Hang Seng .HSI shed 2.8 percent and Shanghai retreated 2.85 percent. “The correction phase in equities could last through February and possibly into March,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management in Tokyo.

After intense negotiations, China on Thursday agreed to accommodate the demands of Pakistani exporters in the amended Free Trade Agreement (FTA) which is expected to be signed in March, a press release issued by the Ministry of Commerce said. The demands and concerns of local exporters were shared during the 9th round of two-day negotiations on China-Pakistan Free Trade Agreement which began on Wednesday. The Pakistani delegation was led by Secretary Commerce Mohammad Younus Dagha while the Chinese side was headed by Vice Minister for Commerce Wang Shouwen. The demands included provision for tariff concessions equivalent to Asean countries.

The centre on Thursday directed provinces to resolve problems confronting farmers – especially sugarcane growers who have not been paid their dues by provincial authorities and mill owners. In a meeting with Prime Minister Shahid Khaqan Abbasi, Minister for National Food Security Syed Ayaz Ali Shah Sherazi apprised the premier that authorities and millers in Sindh were not paying the notified rate fixed by the government to cane growers. The prime minister said that although the issue of sugarcane growers fell in purview of the provincial government, the federal government and the federal cabinet have taken serious notice of the issue.

The government has started negotiations with the UAE and Swiss governments to collect information regarding Pakistanis holding billions of dollars of offshore assets and bank accounts to bring these Pakistanis into the tax net. “We have started negotiations with authorities in Dubai and Switzerland to get information about properties and other assets of Pakistanis,” said Minister of State for Finance Rana Muhammad Afzal while talking to reporters after a meeting of the Standing Committee on Law and Justice at the Parliament House on Thursday. He said Pakistan, the United Arab Emirates and Switzerland were members of the Organisation of Economic Cooperation and Development (OECD) and under the charter of the organisation they had to share information about assets and properties of nationals of each other’s countries. “The process of exchange of such information started among OECD-member countries with effect from Jan 1, 2018,” he said.

The Provincial Development Working Party on Thursday approved six developmental projects with an estimated cost of Rs11531.707 million. The approval was given at a meeting of PDWP chaired by Additional Chief Secretary Shahab Ali Shah. The meeting among others was attended by its members and respective administrative secretaries. According to details, the forum considered 11 projects pertaining to different sectors, including Higher Education, Health, Urban Development and Roads for the uplift of the province. Five projects were deferred due to inadequate design.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

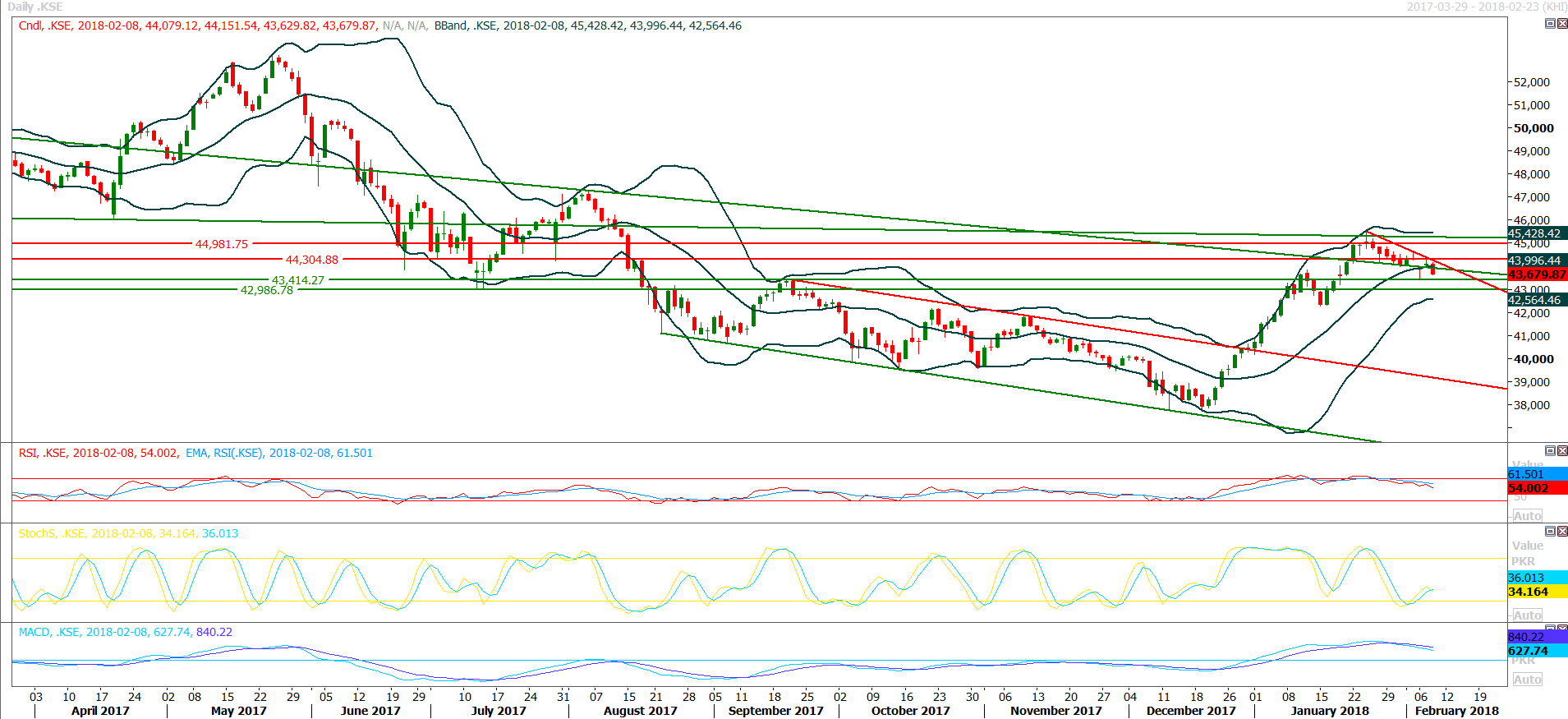

The Benchmark KSE100 Index have finally slipped below a descending trend line which was supporting it since last week and yesterday it had closed below that supportive trend line. Now that trend line would also add pressure on index as it would react as a resistance against any reversal. For current trading session index have supports 43414 and 42980 while resistant regions are standing at 43980 and 44100 points. If index would become able to close below 43414 and 42980 during current trading session then a new bearish trend would be followed in coming days because after today's closing in bearish mode will add further pressure on weekly chart which is already in bearish momentum. Weekly closing below 42980 would change short term trend which would lead index towards 42100 and then further downward. For current trading session its recommended to initiate selling on strenght.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.