Previous Session Recap

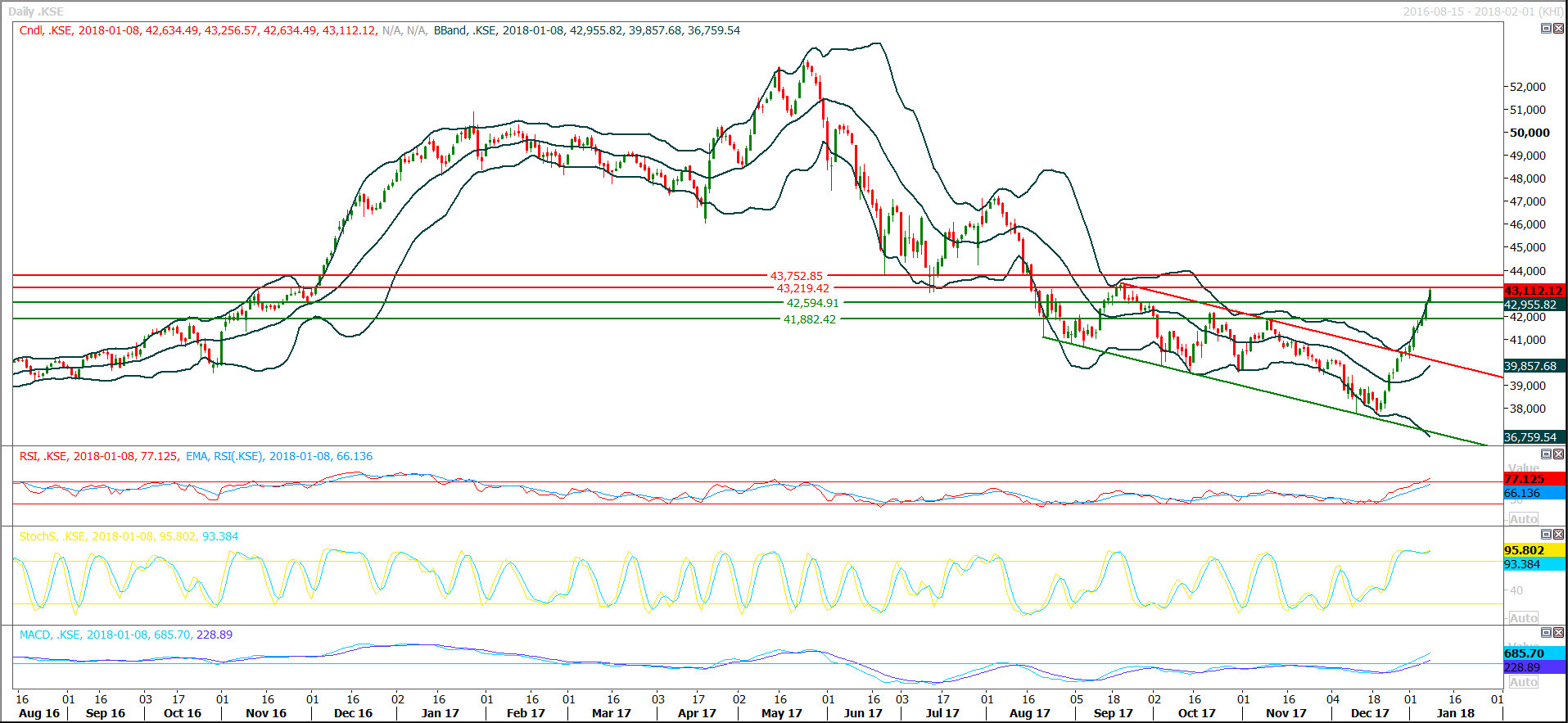

Trading volume at PSX floor increased by 9.66 million shares or 3.70% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42634.49, posted a day high of 43256.57 and a day low of 42634.49 during last trading session. The session suspended at 43112.12 with net change of 588.13 and net trading volume of 125.69 million shares. Daily trading volume of KSE100 listed companies increased by 15.73 million shares or 14.31% on DoD basis.

Foreign Investors remained in net buying postion of 13.67 million shares and net value of Foreign Inflow increased by 11.44 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net buying postions of 6.78 and 6.95 million shares but Foreign Individuals remained in net selling postion of 0.06 million shares. While on the other side Local Companies, Banks and Brokers remained in net selling positions of 8.16, 11.49 and 6.14 million share respectively but Individuals, NBFCs, Mutual Funds and Insurance Companies remained in net buying of 3.08, 1.55, 6.06 and 1.6 million shares respectively.

Analytical Review

Asian shares edged higher on Tuesday, approaching record highs after the S&P 500 extended its winning streak, while the dollar steadied against its major counterparts. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.1 percent at 590.23, not far from its record peak of 591.50 scaled in November 2007. On Wall Street on Monday, the Dow Jones Industrial Average edged down 0.05 percent, the S&P 500 gained 0.17 percent, and the Nasdaq Composite added 0.29 percent. After the best start to a year in more than a decade, investors turned cautious ahead of earnings. Japan’s Nikkei stock index rose 0.8 percent to its highest levels since November 1991, catching up to the previous session’s gains as markets reopened after a holiday on Monday. The dollar index, which tracks the greenback against a basket of six major rival currencies, was steady on the day at 93.348.

Dollar in open market recorded substantial gain on the central bank ruling curbing imports of dollar from the exchange companies. Dollar in the open market hit 113 rupees on back of the last week ruling whereby exchange companies could only import around 35 percent against the surrender of small foreign currencies while 65 percent to be managed by the banks. A senior exchange dealer said that if the central bank revert the decision and allows exchange companies to import dollars against the small currencies, dollar will dip against the domestic currency.

The Progress Report regarding Aggregate Technical & Commercial Losses (AT&C) of Power Distribution Companies (DISCOs), released by the Pakistan Electric Power Company (PEPCO), has revealed that Peshawar Electric Supply Company (PESCO) from KP tops the worst performing DISCOs across the country including all provinces, registering line losses of 141.85 million units. Lahore Electric Supply Company (LESCO) was declared as worst performer in efficiency of power supply among all DISCOs of Punjab , including Faisalabad Electric Supply Company (FESCO), Multan Electric Power Company (MEPCO) Gujranwala Electric Power Company (GEPCO) and Islamabad Electric Supply Company (IESCO).

Government debt-to-GDP ratio witnessed an increase of 1.4 percent to reach 61.6 percent in 2017 from 60.2 percent in 2013, the ministry of finance said on Monday. “The total public debt-to-GDP ratio was recorded at 67.2 percent while total government debt-to-GDP ratio stood at 61.6 percent at end of June 2017. Pakistan witnessed a marginal increase of 1.4 percent (from 60.2 percent in 2013 to 61.6 percent in 2017) in its total government debt-to-GDP ratio during last four years while during the same period global debt-to-GDP ratio increased by about 8 percent,” stated a spokesman of the ministry of finance in a statement.

Chairman Board of Investment Naeem Y Zamindar has said that efforts are well on the way to make Pakistan a key destination for foreign & local investments. While talking to LCCI Senior Vice President Khawaja Khawar Rashid, Vice President Zeshan Khalil and Executive Committee members here at the Lahore Chamber of Commerce & Industry, Chairman BOI said that foreign direct investment is increasing gradually and a target of $ 3.7 billion has been set for the ongoing financial year (FY18).

Its recommended to exercise caution while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index have tried to penetrate its resistant region of 43200 during last trading session but closed below that region therefore it needs to be very cautious as a correction is still due in index and it have resistnace resgions ahead at 43219 and 43752 in coming days. Its recommended to stay side line as Daily Stochastic is trying to generate a bearish crossover along with MOARSI and if succeeded these both could push index into a corrective zone.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.