Previous Session Recap

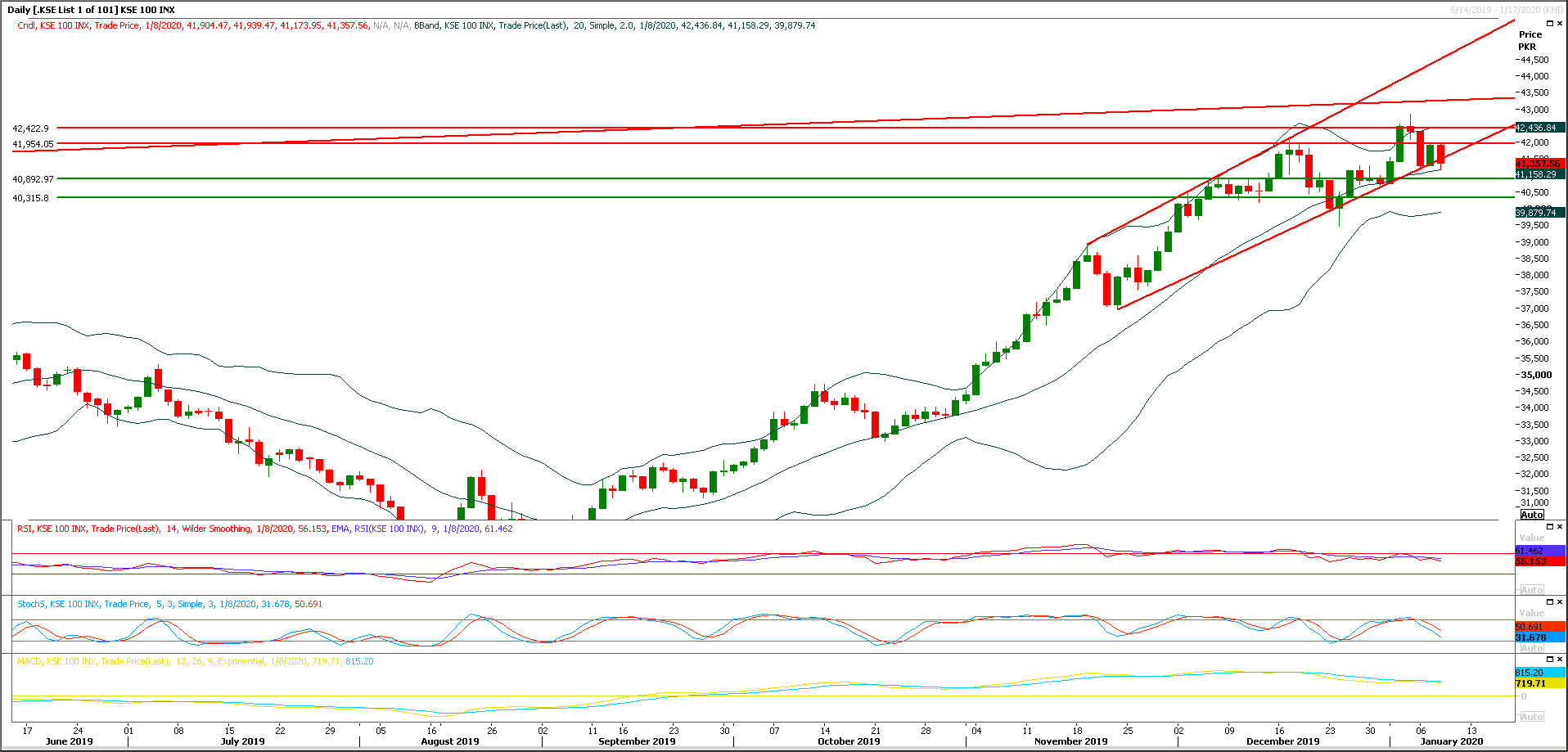

Trading volume at PSX floor increased by 73.18 million shares or 35.37% on DoD basis, whereas the benchmark KSE100 index opened at 41,904.47, posted a day high of 41,939.47 and a day low of 41,173.95 points during last trading session while session suspended at 41,357.56 points with net change of -546.91 points and net trading volume of 209.28 million shares. Daily trading volume of KSE100 listed companies increased by 66.76 million shares or 46.85% on DoD basis.

Foreign Investors remained in net selling positions of 0.46 million shares and value of Foreign Inflow dropped by 0.68 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.032 million shares but Foreign Corporate and Overseas Pakistanis remained in net selling positions of 0.36 and 0.14 million shares. While on the other side Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 15.52, 0.022, 6.40 and 6.83 million shares but Local Individuals, Banks and Mutual Fund remained in net selling positions of 21.29, 2.55 and 2.92 million shares respectively.

Analytical Review

Asian shares erase losses as Mideast tensions ease, oil ticks up

Asian shares and U.S. treasury yields tumbled on Wednesday, while the yen, gold and oil shoAsian stocks rebounded on Thursday and oil edged up as the United States and Iran backed away from the brink of further conflict in the Middle East and investors unwound safety plays. U.S. President Donald Trump responded overnight to an Iranian attack on U.S. forces with sanctions, not violence. Iran offered no immediate signal it would retaliate further over a Jan. 3 U.S. strike that killed one of its senior military commanders. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1%, as did Hong Kong’s Hang Seng and Shanghai blue chips, reversing Wednesday’s losses. Japan’s Nikkei rose 1.8%, lifting stocks to their highest for the year so far, while Australian stocks climbed 1% to just below December’s record high.

World Bank revises growth projections downward

The World Bank on Wednesday slightly lowered country’s growth rate projections for the current fiscal year and next two years owing to continuation of tight monetary policy and fiscal consolidation coupled with external factors. In its latest report “2020 Global Economic Prospects” released on Wednesday, the bank forecast Pakistan’s current year growth rate at 2.4 per cent — about 0.3pc lower than its estimates of June 2019 — before touching 3pc next fiscal year and 3.9pc in FY2022. “Pakistan’s growth is expected to rise to 3pc in the next fiscal year after bottoming out at 2.4pc in FY2019-20, which ends June 30”, said the bank adding that macroeconomic adjustment in the country including a continuation of tight monetary policy and fiscal consolidation is expected to continue.

Fresh roadblock for Tapi as Pakistan seeks gas price cut

The multi-billion dollar Turkmenistan-Afghanistan-Pakistan-India (Tapi) Pipeline project has hit fresh snags as its two major stakeholders and prospective gas purchasers — Islamabad and New Delhi — have sought gas price openers before the project could physically take off. On Wednesday, Pakistan formally constituted a five-member price negotiation committee (PNC) to begin talks with Turkmenistan for price cut after authorities would its existing prices reasonably higher than Liquefied Natural Gas (LNG) being imported from Qatar and other countries.

Ecnec approves seven development projects worth Rs216.4 billion

The Executive committee of the National Economic Council (ECNEC) on Monday approved seven development projects worth Rs216.4 billion that related to poverty alleviation, education, hydropower project and others. Adviser to the Prime Minister on Revenue and Finance Dr Abdul Hafeez Shaikh chaired the meeting of the ECNEC. The ECNEC considered and approved seven projects put forth by Ministry of Planning, Development and Special Initiatives. ECNEC considered and approved the Southern Punjab Poverty Alleviation Project (SPPAP)-IFAD assisted, Revised-III at the total cost of Rs15.52 billion with Rs 7.5 billion as the FEC.

Pakistan now has to import food, regrets minister

Minister for National Food Security and Research Khusro Bakhtiar on Wednesday expressed concern that Pakistan, which used to export food items, has now been transformed into a food-importing country. Presiding over a meeting of the Pakistan Agriculture Research Council board, the minister said that the situation was very serious and the threat of climate change was showing signs by creating a colossal damage. He said that currently the country faced degradation and depletion of natural resources, including water, climate change, resource conflicts, rapid urbanisation, malnutrition and hunger and poverty.

Asian shares and U.S. treasury yields tumbled on Wednesday, while the yen, gold and oil shoAsian stocks rebounded on Thursday and oil edged up as the United States and Iran backed away from the brink of further conflict in the Middle East and investors unwound safety plays. U.S. President Donald Trump responded overnight to an Iranian attack on U.S. forces with sanctions, not violence. Iran offered no immediate signal it would retaliate further over a Jan. 3 U.S. strike that killed one of its senior military commanders. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1%, as did Hong Kong’s Hang Seng and Shanghai blue chips, reversing Wednesday’s losses. Japan’s Nikkei rose 1.8%, lifting stocks to their highest for the year so far, while Australian stocks climbed 1% to just below December’s record high.

The World Bank on Wednesday slightly lowered country’s growth rate projections for the current fiscal year and next two years owing to continuation of tight monetary policy and fiscal consolidation coupled with external factors. In its latest report “2020 Global Economic Prospects” released on Wednesday, the bank forecast Pakistan’s current year growth rate at 2.4 per cent — about 0.3pc lower than its estimates of June 2019 — before touching 3pc next fiscal year and 3.9pc in FY2022. “Pakistan’s growth is expected to rise to 3pc in the next fiscal year after bottoming out at 2.4pc in FY2019-20, which ends June 30”, said the bank adding that macroeconomic adjustment in the country including a continuation of tight monetary policy and fiscal consolidation is expected to continue.

The multi-billion dollar Turkmenistan-Afghanistan-Pakistan-India (Tapi) Pipeline project has hit fresh snags as its two major stakeholders and prospective gas purchasers — Islamabad and New Delhi — have sought gas price openers before the project could physically take off. On Wednesday, Pakistan formally constituted a five-member price negotiation committee (PNC) to begin talks with Turkmenistan for price cut after authorities would its existing prices reasonably higher than Liquefied Natural Gas (LNG) being imported from Qatar and other countries.

The Executive committee of the National Economic Council (ECNEC) on Monday approved seven development projects worth Rs216.4 billion that related to poverty alleviation, education, hydropower project and others. Adviser to the Prime Minister on Revenue and Finance Dr Abdul Hafeez Shaikh chaired the meeting of the ECNEC. The ECNEC considered and approved seven projects put forth by Ministry of Planning, Development and Special Initiatives. ECNEC considered and approved the Southern Punjab Poverty Alleviation Project (SPPAP)-IFAD assisted, Revised-III at the total cost of Rs15.52 billion with Rs 7.5 billion as the FEC.

Minister for National Food Security and Research Khusro Bakhtiar on Wednesday expressed concern that Pakistan, which used to export food items, has now been transformed into a food-importing country. Presiding over a meeting of the Pakistan Agriculture Research Council board, the minister said that the situation was very serious and the threat of climate change was showing signs by creating a colossal damage. He said that currently the country faced degradation and depletion of natural resources, including water, climate change, resource conflicts, rapid urbanisation, malnutrition and hunger and poverty.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is being caged in an upward price wedge on daily chart and now it's trying to bounce back after getting support from rising trend line of that wedge, index had tried to generate a piercing line formation after posting a double bottom at its supportive region but it's recommended to stay cautious because index could fall back if it would not succeed in closing above 42,090 points. Because at this region index would complete its previous gap and also its 61.8% correction therefore this region is getting importance and its recommended to stay cautious near that region because if index would face rejection from this region then it would try to target 40,900 and 40,300 points in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.