Previous Session Recap

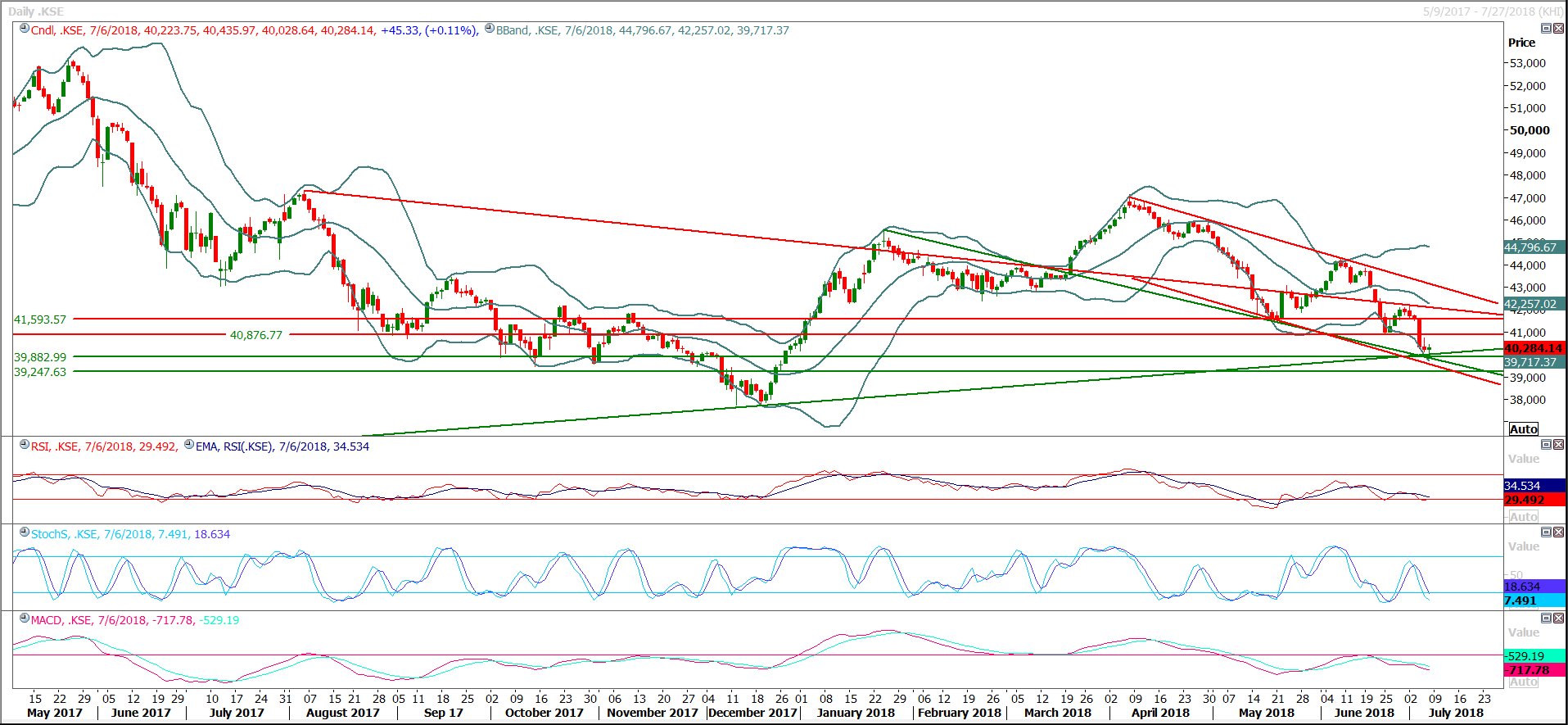

Trading volume at PSX floor dropped by 39.28 million shares or 27.44% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,223.75, posted a day high of 40,435.97 and a day low of 40,028.64 during last trading session. The session suspended at 40,284.14 with net change of 45.33 and net trading volume of 75.86 million shares. Daily trading volume of KSE100 listed companies dropped by 17.47 million shares or 18.71% on DoD basis.

Foreign Investors remained in net buying position of 0.89 million shares but net value of Foreign Inflow dropped by 0.6 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani investors remained in net buying positions of 1.2 and 1.59 million shares but Foreign Corporate investors remained in net selling positions of 1.9 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs and Brokers remained in net buying positions of 6.49, 1.39, 2.14, 0.08 and 3.82 million shares but Mutual Funds and Insurance Companies remained in net selling positions of 14.42 and 0.14 million shares respectively.

Analytical Review

Asia shares rally on U.S. jobs relief, sterling slugged by politics

Asian share markets rallied on Monday as favorable U.S. jobs data whetted risk appetites, while sterling slipped after two members of the British government resigned over Brexit and put the future of Prime Minister Theresa May in doubt. The balanced report helped Wall Street end last week in the black and Japan's Nikkei .N225 followed up with gains of 1.4 percent on Monday. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 1.1 percent, on top of 0.7 percent rally on Friday when the launch of U.S. tariffs on Chinese imports came and went without too many fireworks.

Apex court orders analysis of oil import mechanism

The Supreme Court on Sunday ordered a thorough analysis of the petroleum products import mechanism in the country by examining that the prices at which they reached end-consumers were true and not doubtful due to the involvement of hidden commission and kickbacks. And in order to realise the objective, a three-judge SC bench headed by Chief Justice of Pakistan (CJP) Mian Saqib Nisar ordered Attorney General Khalid Jawed Khan, the managing director of the Pakistan State Oil (PSO) and chairperson of the Oil and Gas Regulatory Authority (Ogra) Uzma Adil Khan to get in touch with the experts on oil pricing and renowned chartered accountants for forensic audit of prices.

Pakistan wasting 10 trillion gallons of water annually

he Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Sunday said our country is more concerned about dams being built by a neighbouring country and less concerned about building dams itself. All the efforts to stop other countries from building dams have remained futile as international institutions and the world community is not supporting our stance, it said. We should stop our efforts on the external front and focus attention on the internal front to ensure availability of water to save Pakistan, said Ghazanfar Bilour, president of the FPCCI. He said that small dams should be built on war footing across the country as mega projects attract controversies which are against the national interests. Moreover, Pakistan continues to waste thirty million acre-foot or ten trillion gallons of water per annum which can be used to quench the thirst of masses while revolutionising the agricultural and industrial sectors, he added.

Crisis worsens as Tarbela dam hits dead level

The scarcity of water in the country has further deteriorated as Tarbela Dam has touched the dead level of 1386 feet and the IRSA is likely to impose new cuts on the provincial share within the next couple of days. “The storage has dropped to 0.977 MAF while the water inflows have decreased to 293,500 cusecs, said IRSA spokesman Khalid Rana said. He said that the IRSA has increased outflows from Mangla from 25,000 cusecs to 45,000 cusecs to meet the provincial demand. Punjab and Sindh will again face the shortfall and the provinces were likely to face 30 to 40 percent shortage at rim stations. Rana said that the total inflows in the rivers on Sunday were 293,500 cusecs while total outflows were also the same. “A weather system having good rainfall will approach by Tuesday/Wednesday which may again increase inflows in all major rivers,” the IRSA spokesman said.

IMF bailout ‘on the cards’ for next govt

The next government, to be chosen in a July 25 election, faces growing fears of a balance of payments crisis with speculation it will have to seek its second IMF bailout in five years, analysts say. The State Bank is running down its foreign reserves and devaluing the currency in a bid to bridge a yawning trade deficit, and the winners of the July 25 election will have "limited time" to act, Fitch ratings agency said. Together, the economic challenges are "horrendous", said Dr Ashfaq Hassan, an analyst and former financial advisor to federal government. "The most important (challenge) will be how to protect Pakistan's balance of payments, how to build Pakistan's foreign exchange reserves and how to fix its fiscal position," he told AFP. Plagued for years by militancy, Pakistan - a rapidly growing country of some 207 million people - has been battling to get its shaky economy back on track and end a years-long chronic energy crisis that has crippled industry.

Asian share markets rallied on Monday as favorable U.S. jobs data whetted risk appetites, while sterling slipped after two members of the British government resigned over Brexit and put the future of Prime Minister Theresa May in doubt. The balanced report helped Wall Street end last week in the black and Japan's Nikkei .N225 followed up with gains of 1.4 percent on Monday. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 1.1 percent, on top of 0.7 percent rally on Friday when the launch of U.S. tariffs on Chinese imports came and went without too many fireworks.

The Supreme Court on Sunday ordered a thorough analysis of the petroleum products import mechanism in the country by examining that the prices at which they reached end-consumers were true and not doubtful due to the involvement of hidden commission and kickbacks. And in order to realise the objective, a three-judge SC bench headed by Chief Justice of Pakistan (CJP) Mian Saqib Nisar ordered Attorney General Khalid Jawed Khan, the managing director of the Pakistan State Oil (PSO) and chairperson of the Oil and Gas Regulatory Authority (Ogra) Uzma Adil Khan to get in touch with the experts on oil pricing and renowned chartered accountants for forensic audit of prices.

he Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Sunday said our country is more concerned about dams being built by a neighbouring country and less concerned about building dams itself. All the efforts to stop other countries from building dams have remained futile as international institutions and the world community is not supporting our stance, it said. We should stop our efforts on the external front and focus attention on the internal front to ensure availability of water to save Pakistan, said Ghazanfar Bilour, president of the FPCCI. He said that small dams should be built on war footing across the country as mega projects attract controversies which are against the national interests. Moreover, Pakistan continues to waste thirty million acre-foot or ten trillion gallons of water per annum which can be used to quench the thirst of masses while revolutionising the agricultural and industrial sectors, he added.

The scarcity of water in the country has further deteriorated as Tarbela Dam has touched the dead level of 1386 feet and the IRSA is likely to impose new cuts on the provincial share within the next couple of days. “The storage has dropped to 0.977 MAF while the water inflows have decreased to 293,500 cusecs, said IRSA spokesman Khalid Rana said. He said that the IRSA has increased outflows from Mangla from 25,000 cusecs to 45,000 cusecs to meet the provincial demand. Punjab and Sindh will again face the shortfall and the provinces were likely to face 30 to 40 percent shortage at rim stations. Rana said that the total inflows in the rivers on Sunday were 293,500 cusecs while total outflows were also the same. “A weather system having good rainfall will approach by Tuesday/Wednesday which may again increase inflows in all major rivers,” the IRSA spokesman said.

The next government, to be chosen in a July 25 election, faces growing fears of a balance of payments crisis with speculation it will have to seek its second IMF bailout in five years, analysts say. The State Bank is running down its foreign reserves and devaluing the currency in a bid to bridge a yawning trade deficit, and the winners of the July 25 election will have "limited time" to act, Fitch ratings agency said. Together, the economic challenges are "horrendous", said Dr Ashfaq Hassan, an analyst and former financial advisor to federal government. "The most important (challenge) will be how to protect Pakistan's balance of payments, how to build Pakistan's foreign exchange reserves and how to fix its fiscal position," he told AFP. Plagued for years by militancy, Pakistan - a rapidly growing country of some 207 million people - has been battling to get its shaky economy back on track and end a years-long chronic energy crisis that has crippled industry.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index have tried to bounce back after getting support from a horizontal supportive region which falls on a crossover of two supportive trend lines but confirmation of said reversal is still pending and market sentiment would remain bearish until index would close above 40,860 points on daily chart. Momentum indicators are trying to start a pullback but daily and weekly momentum is bearish which could lead index towards 39,200 points. During current trading session a spike could be witnessed but it’s recommended to initiate selling on strength once index reached near 40,860 points with strict stop loss of 41,230 points.

On short and mid-term basis index is moving in a bearish channel and third wave of its Elliot wave just have completed and right now its preparing for its fourth wave which would be correction of last bearish rally, immediately index would try to target 40,860 and 41,230 points for first secondary wave and then after a correction of said move index would try to reach 41,593 or 42,400 points but from that region fifth wave of current Elliot would be started which would lead index towards new low this year therefore it’s recommended to adopt swing trading strategy and avoid any kind of long term investments because for investments better prices would be found in coming two or three weeks.

On short and mid-term basis index is moving in a bearish channel and third wave of its Elliot wave just have completed and right now its preparing for its fourth wave which would be correction of last bearish rally, immediately index would try to target 40,860 and 41,230 points for first secondary wave and then after a correction of said move index would try to reach 41,593 or 42,400 points but from that region fifth wave of current Elliot would be started which would lead index towards new low this year therefore it’s recommended to adopt swing trading strategy and avoid any kind of long term investments because for investments better prices would be found in coming two or three weeks.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.