Previous Session Recap

Trading volume at PSX floor increased by 8.31 million shares or 16.22% on DoD basis, whereas the benchmark KSE100 index opened at 34,184.57, posted a day high of 34,229.63 and a day low of 33,686.20 points during last trading session while session suspended at 33,742.68 points with net change of -447.34 points and net trading volume of 46.79 million shares. Daily trading volume of KSE100 listed companies increased by 4.44 million shares or 10.48% on DoD basis.

Foreign Investors remained in net buying positions of 0.07 million shares and net value of Foreign Inflow increased by 0.62 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net buying positions of 0.70 and 0.07 million shares but Foreign Individuals investors remained in net selling positions of 0.71 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net selling positions of 22.49, 9.60, 0.26, 5.82 and 0.32 million sharers respectively but Local Individuals and Brokers remained in net buying positions of 13.36 and 25.03 million shares.

Analytical Review

Asian stocks hobbled by fading expectations for aggressive Fed rate cut

Asian stocks struggled to rebound on Tuesday as investors came to terms with sharply reduced expectations the Federal Reserve will deliver a large interest rate cut at the end of July. Those views were bolstered after solid gains in U.S. jobs for June and pushed down Wall Street for the second straight day. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.1% in early trade, after falling 0.6% the previous day. Japan’s Nikkei rose 0.5% thanks in part to the yen’s retreat against the dollar. On Wall Street, the S&P 500 lost 0.48% while the Nasdaq Composite dropped 0.78%, led by fall in Apple Inc. Money market futures <0#FF:> are still fully pricing in a 25 basis point cut at the Fed’s next policy meeting on July 30-31, but have almost priced out a larger 50 basis point reduction.

ADB plans to lend Pakistan $10 billion for uplift projects

The Asian Development Bank (ADB) has planned to support Pakistan with indicative lending of up to $10 billion for various development projects and programs during the next five years.The ADB and Pakistan held a series of consultations to formulate a new Country Partnership Strategy (CPS), which will guide ADB’s engagement in the country from 2020 to 2024. Nadeem Babar, Special Assistant to the Prime Minister for the Petroleum Division, discussed the implementation of energy sector reforms. Secretary for the Economic Affairs Division Mr. Noor Ahmed, ADB Senior Advisor for Central and West Asia Mr. Muhammad Ehsan Khan, ADB Country Director for Pakistan Ms. Xiaohong Yang, and ADB’s Director for Regional Cooperation and Operations Mr. Safdar Parvez also discussed challenges and the priorities that the country partnership strategy should address.

APTMA demands removal of arrears from gas bills

All Pakistan Textile Mills Association (APTMA) Chairman Syed Ali Ahsan has urged the government to direct SNGPL to remove unjustified arrears from gas bills and sort out the issues regarding subsidy and LPS once for all. Addressing a press confere ce at APTMA Punjab office on Monday, he said the industry was not taking new investment decisions due to uncertainty in gas pricing. Chairman APTMA Punjab Adil Bashir and other office bearers were also present. SNGPL has issued gas bills at full RLNG tariff for the month of June, 2019, i.e. Rs.1798.32/MMBTU. Syed Ali Ahsan said the ministry of finance had advised to use average exchange rate of the whole month. But, he said, SNGPL was charging higher rate.

IMF gunning for debt reduction, programme shows

Pakistan has entered a high tax environment for the foreseeable future with Rs1.56 trillion additional taxes this year, followed by another Rs1.5tr next year and yet another Rs1.31tr the year after, according to a staff report released by the International Monetary Fund (IMF) on Monday. The agreement signed with the IMF by Adviser to the Prime Minister on Finance Abdul Hafeez Shaikh and State Bank of Pakistan Governor Reza Baqir also requires an increase in electricity tariff again in August this year and ensures Rs1.3tr refunds from the provinces out of the National Finance Commission share to honour its commitments with the IMF.

Pakistan to get $1.65bn net receipts out of $6bn IMF package

Pakistan will get net receipts of about $1.65 billion in four years from the International Monetary Fund (IMF) under the just concluded $6bn bailout as it delivers on a steep macroeconomic adjustment plan. A senior government official told Dawn that beginning this year Pakistan will receive a total of $6bn in about three years ending 2021-22 from the IMF, while it has to repay about $4.355bn in four years ending 2022-23, showing net receipts of $1.65bn. He said the government is expected to receive first disbursement of about $1bn this week under the $6bn Extended Fund Facility (EFF) that would boost the foreign exchange reserves in the short term, but its repayment obligations under the previous $6.4bn EFF have already begun. The Fund’s previous EFF had envisaged a repayment period ranging between four-and-a-half years and 10 years, with repayments in 12 equal semi-annual installments. The 12 disbursements by the IMF had started during the fiscal year 2013-14 and completed in September 2016. The repayments under that programme started in March 2019 with $532 million, including $70m interest charges, and will continue until June 2026.

Asian stocks struggled to rebound on Tuesday as investors came to terms with sharply reduced expectations the Federal Reserve will deliver a large interest rate cut at the end of July. Those views were bolstered after solid gains in U.S. jobs for June and pushed down Wall Street for the second straight day. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.1% in early trade, after falling 0.6% the previous day. Japan’s Nikkei rose 0.5% thanks in part to the yen’s retreat against the dollar. On Wall Street, the S&P 500 lost 0.48% while the Nasdaq Composite dropped 0.78%, led by fall in Apple Inc. Money market futures <0#FF:> are still fully pricing in a 25 basis point cut at the Fed’s next policy meeting on July 30-31, but have almost priced out a larger 50 basis point reduction.

The Asian Development Bank (ADB) has planned to support Pakistan with indicative lending of up to $10 billion for various development projects and programs during the next five years.The ADB and Pakistan held a series of consultations to formulate a new Country Partnership Strategy (CPS), which will guide ADB’s engagement in the country from 2020 to 2024. Nadeem Babar, Special Assistant to the Prime Minister for the Petroleum Division, discussed the implementation of energy sector reforms. Secretary for the Economic Affairs Division Mr. Noor Ahmed, ADB Senior Advisor for Central and West Asia Mr. Muhammad Ehsan Khan, ADB Country Director for Pakistan Ms. Xiaohong Yang, and ADB’s Director for Regional Cooperation and Operations Mr. Safdar Parvez also discussed challenges and the priorities that the country partnership strategy should address.

All Pakistan Textile Mills Association (APTMA) Chairman Syed Ali Ahsan has urged the government to direct SNGPL to remove unjustified arrears from gas bills and sort out the issues regarding subsidy and LPS once for all. Addressing a press confere ce at APTMA Punjab office on Monday, he said the industry was not taking new investment decisions due to uncertainty in gas pricing. Chairman APTMA Punjab Adil Bashir and other office bearers were also present. SNGPL has issued gas bills at full RLNG tariff for the month of June, 2019, i.e. Rs.1798.32/MMBTU. Syed Ali Ahsan said the ministry of finance had advised to use average exchange rate of the whole month. But, he said, SNGPL was charging higher rate.

Pakistan has entered a high tax environment for the foreseeable future with Rs1.56 trillion additional taxes this year, followed by another Rs1.5tr next year and yet another Rs1.31tr the year after, according to a staff report released by the International Monetary Fund (IMF) on Monday. The agreement signed with the IMF by Adviser to the Prime Minister on Finance Abdul Hafeez Shaikh and State Bank of Pakistan Governor Reza Baqir also requires an increase in electricity tariff again in August this year and ensures Rs1.3tr refunds from the provinces out of the National Finance Commission share to honour its commitments with the IMF.

Pakistan will get net receipts of about $1.65 billion in four years from the International Monetary Fund (IMF) under the just concluded $6bn bailout as it delivers on a steep macroeconomic adjustment plan. A senior government official told Dawn that beginning this year Pakistan will receive a total of $6bn in about three years ending 2021-22 from the IMF, while it has to repay about $4.355bn in four years ending 2022-23, showing net receipts of $1.65bn. He said the government is expected to receive first disbursement of about $1bn this week under the $6bn Extended Fund Facility (EFF) that would boost the foreign exchange reserves in the short term, but its repayment obligations under the previous $6.4bn EFF have already begun. The Fund’s previous EFF had envisaged a repayment period ranging between four-and-a-half years and 10 years, with repayments in 12 equal semi-annual installments. The 12 disbursements by the IMF had started during the fiscal year 2013-14 and completed in September 2016. The repayments under that programme started in March 2019 with $532 million, including $70m interest charges, and will continue until June 2026.

Market is expected to remain volatile during current trading session.

Technical Analysis

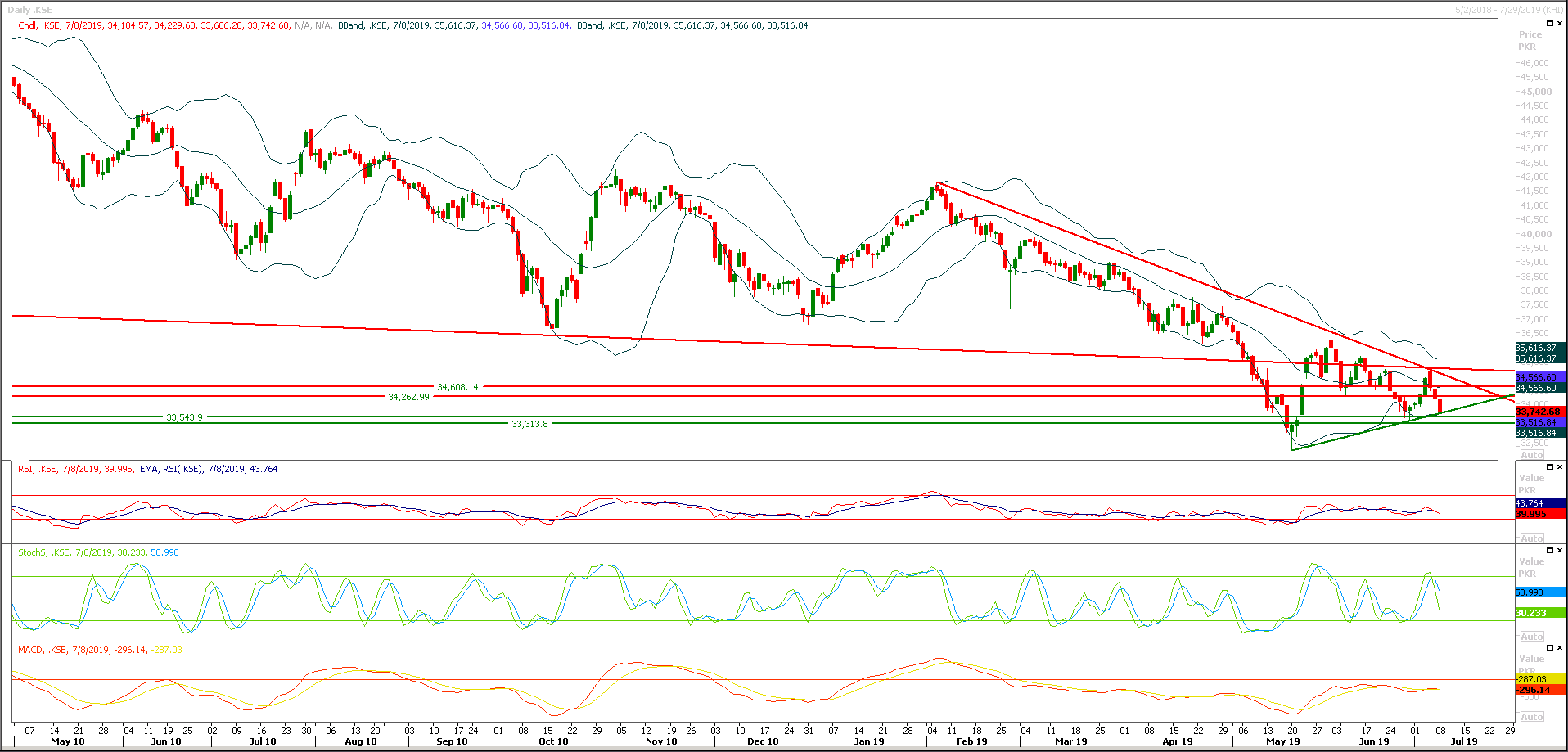

The Benchmark KSE100 Index have penetrated below its major supportive region of 34,000 points during last trading session and right now it's going to find a support at a rising trend line along with another horizontal support. It's recommended to stay cautious during current trading session because if index would succeed in penetration below 33,700 and 33,500 points then a new low would be witnessed in coming days. As of now its recommended to post strict stop loss on long positions and avoid initiating any short positions until index would close below 33,500 points on daily chart. In case of reversal index would face resistance at 34,000 and 34,260 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.