Previous Session Recap

Trading volume at PSX floor increased by 20.84 million shares or 14.63% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43416.46, posted a day high of 43475.56 and a day low of 42940.70 during last trading session. The session suspended at 43072.74 with net change of -368.44 and net trading volume of 69.03 million shares. Daily trading volume of KSE100 listed companies increased by 23.49 million shares or 51.6% on DoD basis.

Foreign Investors remained in net selling position of 2.15 million shares and net value of Foreign Inflow dropped by 2.7 million US Dollars. Categorically, Foreign Corporate Investors remained in net selling positions of 3.21 million shares but Overseas Pakistanis remained in net buying positions of 1.07 million shares. While on the other side Local Individuals, Banks, NBFCs and Insurance Companies remained in net buying positions of 0.58, 1.07, 2.96 and 10.6 million shares but Local Companies, Mutual Funds and Brokers remained in net selling positions of 2.64, 9.7 and 1.12 million shares respectively.

Analytical Review

Asian shares rallied and the safe-haven yen eased on Friday after North Korean leader Kim Jong Un offered to stop nuclear and missile testing and U.S. President Donald Trump agreed to a meeting that could come before May. The chance of any easing in geopolitical tensions in the region helped Japan’s Nikkei climb 2.3 percent. South Korean stocks enjoyed their best day since May with a rise of 1.76 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6 percent, while Australia firmed 0.5 percent.

Investors at the Bin Qasim Industrial Park (BQIP) and Korangi Creek Industrial Park (KCIP) allege that bureaucratic hurdles of National Investment Park (NIP) are delaying the implementation of projects, thereby resulting in mountings costs and time overruns. Sources told Dawn on Thursday that Hyundai had originally planned to set up a plant at BQIP. However, NIP’s bureaucratic issues forced the Korean auto giant to shift investment to the Faisalabad Special Economic Zone (FIEDMC). The sources added that Al-Futtaim Motors was also allotted 50 acres at BQIP to set up Renault car assembly plant. In November 2017, Groupe Renault and Al-Futtaim had signed definitive agreements to assemble vehicles at a new plant in Karachi. However, repeated delays by the Board of Directors of NIP forced the company to change the plant’s location to Faisalabad.

International brands continue selling Pakistan-origin goods due to non-finalisation of Geographical Indication (GI) Law that aims to protect commercial heritage of the country’s products including Basmati rice and Ajrak. The law is pending for the last 17 years due to differences between large lobbies leading to failure of market place regulation. However, the Federal Cabinet in its meeting held early this week has authorised the Commerce Division to initiate legislation on the GI Law.

The government signed implementation agreements on Thursday with two coal-based private power projects of 990 megawatts for commercial operations in 2021. The agreements were signed between the Private Power & Infrastructure Board (PPIB) on behalf of the government, the 660MW Lucky Electric and the 330MW Siddiq Sons involving a total investment of $1.490 billion. The implementation agreement is the final stage to kick-start physical work and enable investors to achieve the financial closing.

The government on Thursday considered several options for the segregation of core and non-core businesses of Pakistan International Airlines including carving-out legacy liabilities from PIA to improve the financial situation of the core business and enable future investment. Given the quantum of outstanding liabilities vis-à-vis the intrinsic value of underlying assets (and operating cash flow of the business), the government considered a proposal to carve-out legacy liabilities from PIA to improve the financial situation of the core business and enable future investment. Federal Minister for Privatization, Daniyal Aziz chaired a high level meeting with the officials of Aviation Division, Civil Aviation Authority, Ministry of Finance, PIA, and SECP. The meeting was held to discuss the proposed segregation of core and non-core businesses of PIA, prior to valuation of assets and liabilities.

Market seems to remain volatile during current trading session therefore its recommended to practice caution.

Technical Analysis

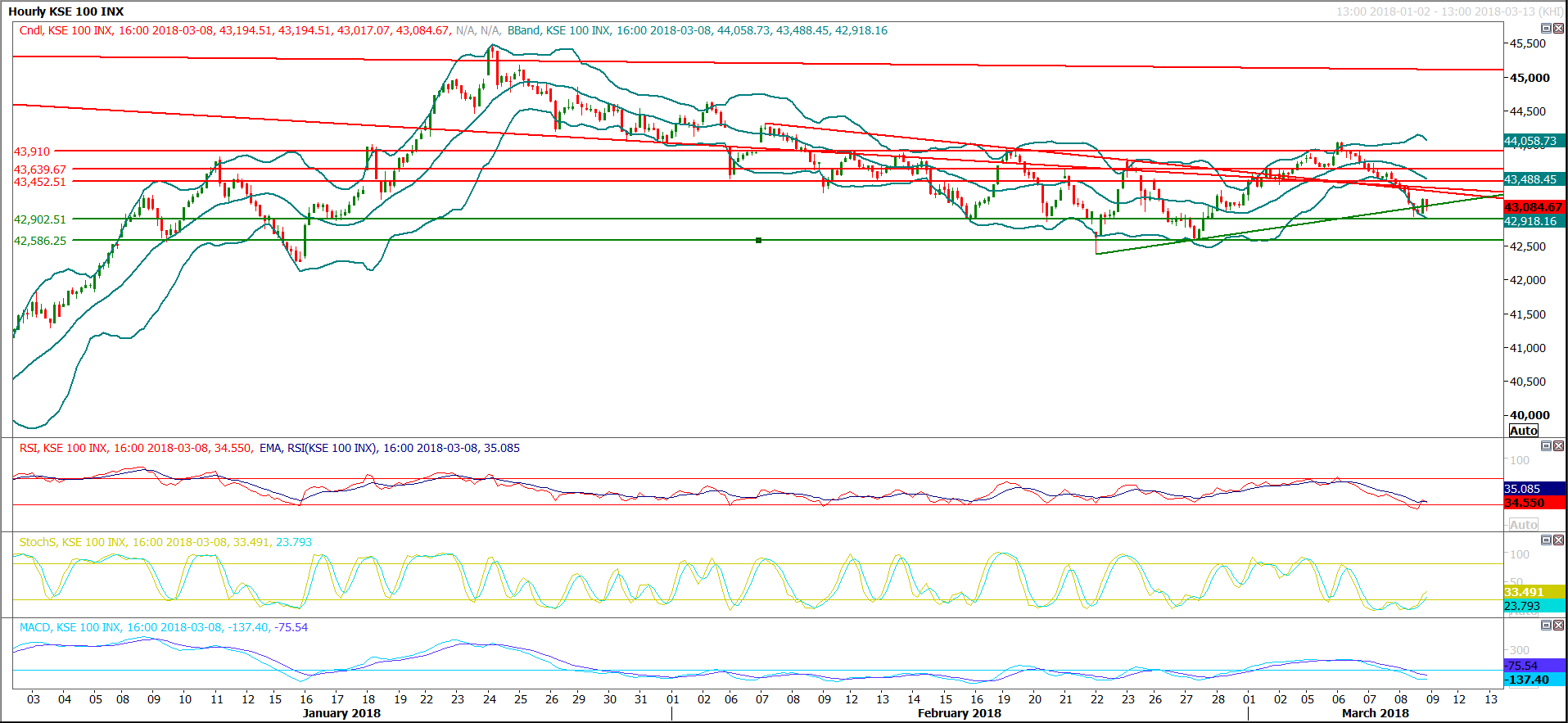

The Benchmark KSE100 Index have tried to penetrate a triangle on hourly chart in bearish direction but again closed at supportive trend line of said triangle, as of right now index is capped by a two resistant trend lines at 43290 and 43350 points while third and major resistance is standing at 43452 points which is a horizontal resistance. On Intraday basis index may take a spike to fulfil its correction on hourly chart but untill unless it closed above 43452 now its recommended to sell on strength with strict stop loss of 43450 points. If index would become able to slide below 42900 then next supportive regions would be 42586 and 42316 points. Being last day of the week current trading session is very important becuase today's closing below 42800 would change market sentiment to bearish, therefore its recommended to practice caution while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.