Previous Session Recap

Trading volume at PSX floor dropped by 9.21 million shares or 8.64%,DoD basis, whereas, the benchmark KSE100 Index opened at 41037.59, posted a day high of 41293.80 and a day low of 40970.62 during the last trading session. The session suspended at 41259.16 with a net change of 209.94 and net trading volume of 57.22 million shares. Daily trading volume of KSE100 listed companies increased by 3.95 million shares or 7.42%,DoD basis.

Foreign Investors remained in a net buying position of 1.87 million shares and net value of Foreign inflow increased by 1.53 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani Investors remained in net selling positions of 0.03 and 0.07 million shares but Foreign Corporate Investors remained in a net buying position of 1.97 million shares. While on the other side Local Individuals and Banks remained in net buying positions of 1.86 and 0.88 million shares but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 0.6, 2.23, 0.28 and 0.76 million shares respectively.

Analytical Review

The All Pakistan Oil Tankers Association (APOTA) has announced to observe a strike across the country from November 13, which is likely to disrupt the countrywide fuel supply to filling stations. According to APOTA Chairman Yousuf Shahwani, the Petroleum Division and the Oil and Gas Regulatory Authority (OGRA) were dragging their heels and not implementing a decision with regard to an increase in transportation fares. In a statement, Shahwani said that both parties had reached a decision that the transportation fares would be increased by 20 percent from November 1, but authorities concerned had failed to implement the hike in fares.

Sugar Advisory Board (SAB), an inter-provincial body, has recommended export of 1.5 millions of sugar in 2017-18 but the volume of subsidy is yet to be finalised by the stakeholders, well-informed sources in Ministry of Industries and Production (MoI&P) told Business Recorder. Commerce Ministry, sources said, has sent a letter stating that previously the level of subsidy for export of sugar was calculated by the Ministry of Industries and Production and conveyed to Commerce which was then considered by the inter-ministerial committee constituted by the Prime Minister and was recommended to ECC for approval.

The Oil Compa¬nies Advisory Council (OCAC) — a representative body of around a dozen oil marketing companies (OMCs) and refineries — threatened Honda Pakistan on Wednes¬day to withdraw its complaint about the alleged sale of low-quality fuel in the market or face legal action. But OCAC’s difficulties appeared to have been compounded by question marks raised from within its ranks when one of its key members – Hascol Petroleum – also supported Honda’s allegation of high manganese content in petrol and asked the government to upgrade fuel quality in the market and subject fuels to stringent standard checks.

Cherat Packaging Limited (CPL) has installed and commissioned the fifth papersack plant - Universal Papersack Line for producing cement bags. The fifth line of papersack cement bag manufacturing plant has been acquired from leading European supplier namely M/s Windmoller and Holscher. It is one of the most advanced plants in the world. With this extension, the production capacity of the company has increased from 265 million to 400 million paper bags per annum, the company in material information sent to Pakistan Stock Exchange on Wednesday said. Besides conventional cement bags, it will also be able to produce smaller sized bags for other related products. The new plant has been installed at the existing factory site of the Company in Gadoon Amazai, KPK province.

Today ATRL, ISL , PAEL and PSO may lead the market in the positive direction.

Technical Analysis

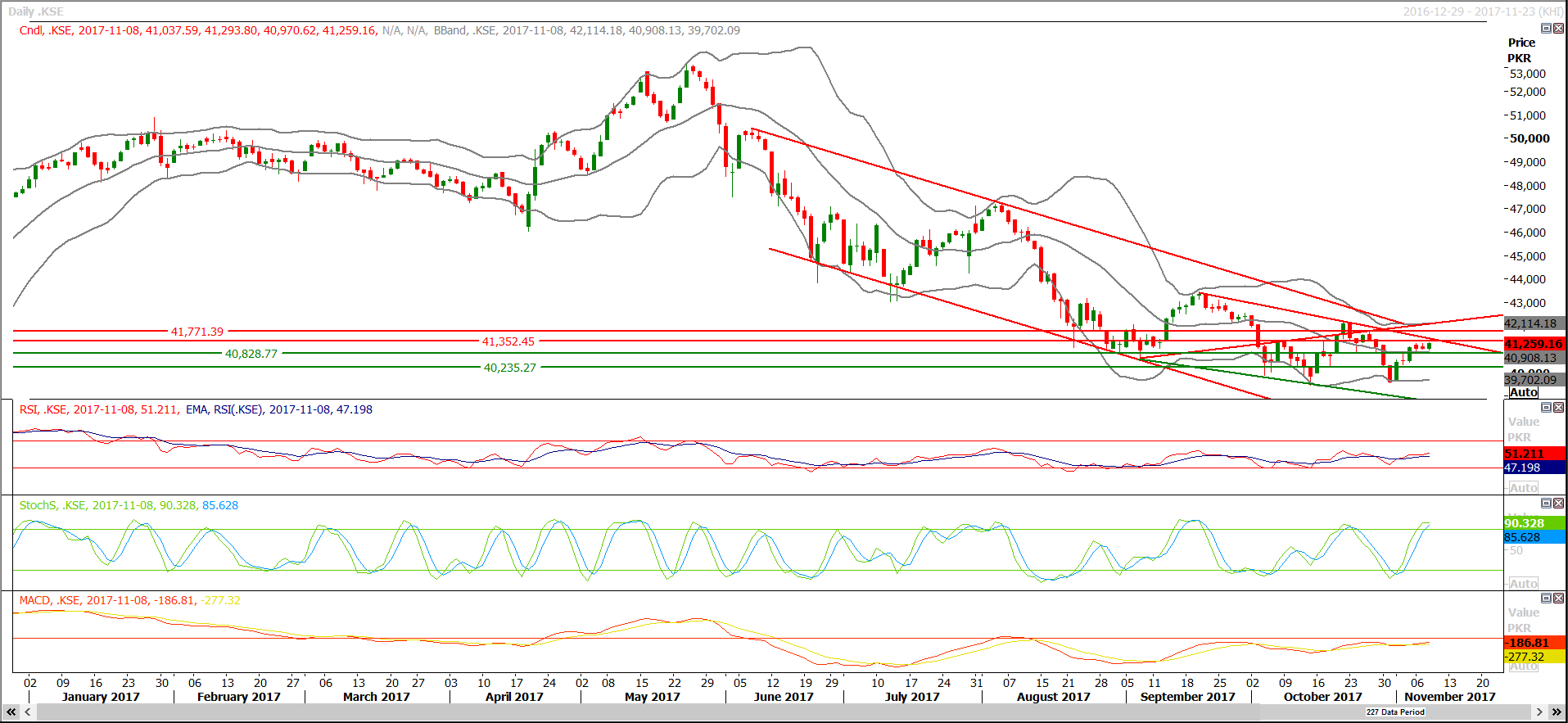

The Benchmark KSE100 Index is capped by a resistant trend line at its triple top and daily stochastic is trying to generate a bearish crossover which may expire current bullish momentum if succeeded. As of now Index is caged between 40820 and 41360 and breakout of either side might push index in respective direction for further 500-700 points therefore a cautious trading strategy is recommended for the current trading session. It recommended to sell on strength until index gives a clear breakout of 41360. As long as supports are concerned Index have supportive region at 40820 and 40240.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.