Previous Session Recap

Trading volume at PSX floor dropped by 52.25 million shares or 18.87% on DoD basis, whereas the Benchmark KSE100 index opened at 41,623.58, posted a day high of 41,650.70 and day low of 41,284.64 points during last trading session while session suspended at 41,367.38 with net change of -176.60 points and net trading volume of 133.41 million shares. Daily trading volume of KSE100 listed companies dropped by 36.31 million shares or 21.39% on DoD basis.

Foreign Investors remained in net buying position of 1.75 million shares and net value of Foreign Inflow increased by 0.03 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net buying positions of 0.98 and 0.78 million shares respectively. While on the other side Local Individuals and NBFCs remained in net buying positions of 8.44 and 0.27 million shares respectively but Local Companies, Banks, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 0.15, 3.19, 0.73, 3.50 and 2.64 million shares respectively.

Analytical Review

Asia stocks pull back from one-month high as Fed tempers rally

Asian stocks pulled back from a one-month high on Friday as the Federal Reserve appeared poised to deliver another interest rate hike next month, paring gains made earlier this week after U.S. midterm elections triggered a global equities rally. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.1 percent and was headed for a loss of 1 percent for the week. On Thursday, the index hit its highest level since Oct. 8. Australian stocks slipped 0.4 percent, South Korea's KOSPI .KS11 edged down 0.3 percent and Japan's Nikkei .N225 shed 0.8 percent.

Chinese assurance for doubling Pak imports lauded

President Islamabad Chamber of Commerce & Industry (ICCI) Ahmed Hassan Moughal has said that the assurances of Chinese leadership during the recent visit of Prime Minister of Pakistan to China to double its imports from Pakistan are commendable. In a statement issued here on Thursday, Ahmed Hassan Moughal termed it a positive development as it would help in reducing Pakistan’s trade imbalance with China and to improve the country’s dwindling forex reserves. However, he said that the Pakistani leadership should have pressed with the Chinese leadership for enhanced market access to Pakistan on similar lines as China has given to Bangladesh and member countries of ASEAN.

PR rehabilitates around 789km track across country

Pakistan Railways has rehabilitated around 789.34 kilometer track by removing temporary speed restrictions and increasing speeds for ensuring sustainable train operation across the country. “The rehabilitation work was carried on its 14 different routes in the four provinces, under various Public Sector Development Programme (PSDP) projects,” an official in the Ministry of Railway told APP here Thursday. Giving provinces wise detail of the rehabilitated track, he said 397.05 km track was rehabilitated in Punjab, 215.60 km in Sindh, 23.69 km in Khyber Pakhtunkhwa and 153.00 km in Balochistan.

PTCL upgrades exchanges in Lahore

PTCL’s key exchanges located in DHA, Guldasht, Gulshan Ravi, Johar Town and WAPDA Town in Lahore have been upgraded under its Network Transformation Project (NTP). The customers residing in these areas can now enjoy and experience reliable high-speed unlimited internet, says a press release. As part of NTP, PTCL is in the process of transforming 100 exchanges. Out of them, 53 exchanges have already been transformed.

Tea worth $148.32 million imported in 1st quarter

Tea import into the country during first quarter of current financial year grew by 8.51 percent as compared to corresponding period of last year as tea worth $148.325 million was imported as compared to import of $136.687 million of same period of last year.During the period from July-September, 2018-19, about 55,749 metric tons of tea was imported as compared to imports of 45,426 metric tons of the same period of last year. However, import of spices during the period under review reduced by 12.37 percent and it was recorded at 34,164 metric tons as compared to imports of 39,466 metric tons of the same period of last year, it added. Spices worth $40.698 million were imported in three months of current financial year. Meanwhile, the imports of edible oil including soyabean and palm also reduced by 70.47 percent and 4.82 percent respectively as the import of soyabean oil into the country was recorded at $22.769 million as compared to $77.113 million of same period of last year.

Asian stocks pulled back from a one-month high on Friday as the Federal Reserve appeared poised to deliver another interest rate hike next month, paring gains made earlier this week after U.S. midterm elections triggered a global equities rally. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.1 percent and was headed for a loss of 1 percent for the week. On Thursday, the index hit its highest level since Oct. 8. Australian stocks slipped 0.4 percent, South Korea's KOSPI .KS11 edged down 0.3 percent and Japan's Nikkei .N225 shed 0.8 percent.

President Islamabad Chamber of Commerce & Industry (ICCI) Ahmed Hassan Moughal has said that the assurances of Chinese leadership during the recent visit of Prime Minister of Pakistan to China to double its imports from Pakistan are commendable. In a statement issued here on Thursday, Ahmed Hassan Moughal termed it a positive development as it would help in reducing Pakistan’s trade imbalance with China and to improve the country’s dwindling forex reserves. However, he said that the Pakistani leadership should have pressed with the Chinese leadership for enhanced market access to Pakistan on similar lines as China has given to Bangladesh and member countries of ASEAN.

Pakistan Railways has rehabilitated around 789.34 kilometer track by removing temporary speed restrictions and increasing speeds for ensuring sustainable train operation across the country. “The rehabilitation work was carried on its 14 different routes in the four provinces, under various Public Sector Development Programme (PSDP) projects,” an official in the Ministry of Railway told APP here Thursday. Giving provinces wise detail of the rehabilitated track, he said 397.05 km track was rehabilitated in Punjab, 215.60 km in Sindh, 23.69 km in Khyber Pakhtunkhwa and 153.00 km in Balochistan.

PTCL’s key exchanges located in DHA, Guldasht, Gulshan Ravi, Johar Town and WAPDA Town in Lahore have been upgraded under its Network Transformation Project (NTP). The customers residing in these areas can now enjoy and experience reliable high-speed unlimited internet, says a press release. As part of NTP, PTCL is in the process of transforming 100 exchanges. Out of them, 53 exchanges have already been transformed.

Tea import into the country during first quarter of current financial year grew by 8.51 percent as compared to corresponding period of last year as tea worth $148.325 million was imported as compared to import of $136.687 million of same period of last year.During the period from July-September, 2018-19, about 55,749 metric tons of tea was imported as compared to imports of 45,426 metric tons of the same period of last year. However, import of spices during the period under review reduced by 12.37 percent and it was recorded at 34,164 metric tons as compared to imports of 39,466 metric tons of the same period of last year, it added. Spices worth $40.698 million were imported in three months of current financial year. Meanwhile, the imports of edible oil including soyabean and palm also reduced by 70.47 percent and 4.82 percent respectively as the import of soyabean oil into the country was recorded at $22.769 million as compared to $77.113 million of same period of last year.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

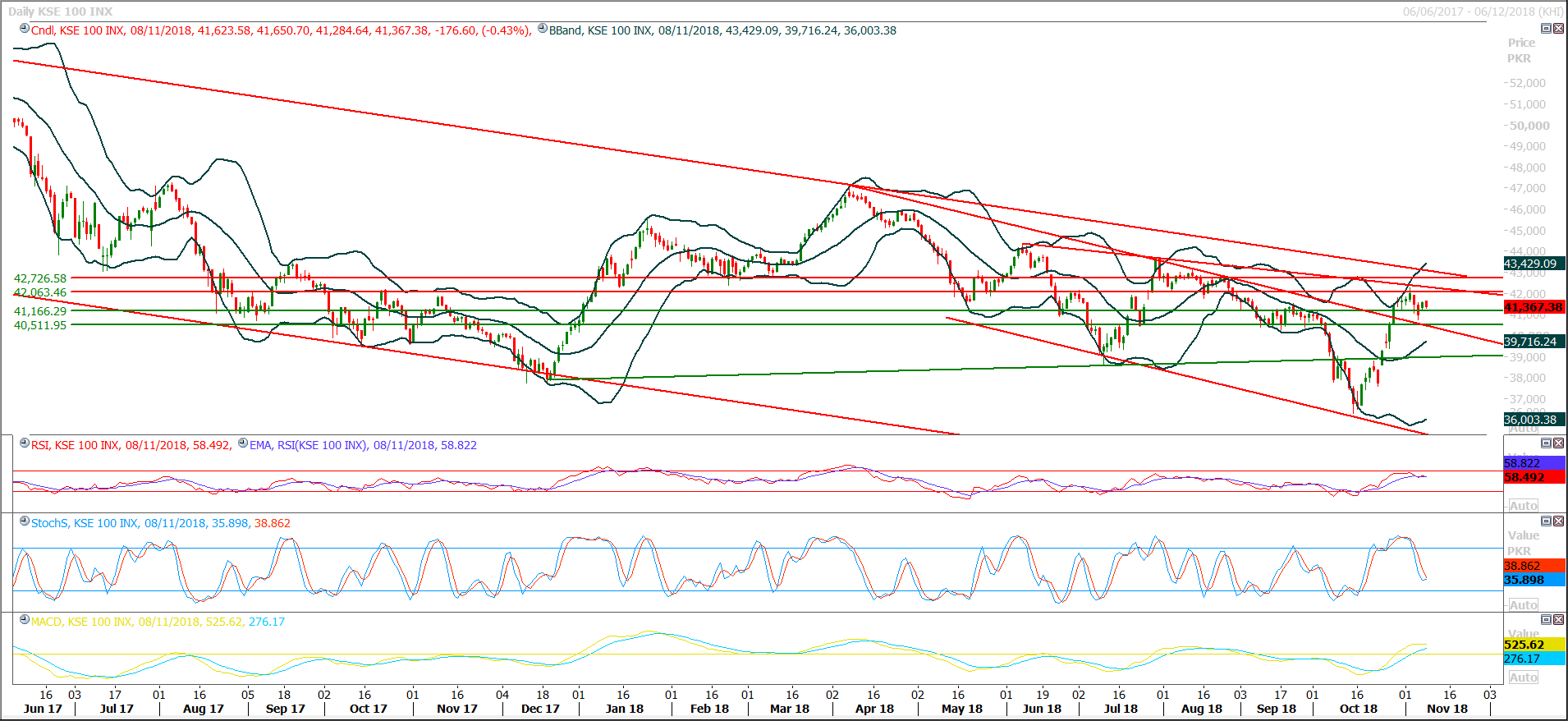

Technical Analysis

The Benchmark KSE100 Index have tried to generate a bearish engulfing during last trading session and it partially have succeeded in doing so, weekly chart is moving momentum and daily momentum indicators already have downside prevailing effect since last three trading session. Therefore it’s being clear that index may face a strong resistance at its weekly double top at 42,243 points and right now hourly Stochastic and MAORSI have generated a bearish crossover and these both indicators would add pressure on index during last trading session which may lead for a dip in first half of current trading session. Index have major supportive region at 41,000 points and if it would succeed in penetrating below 41,000 points then it can target 40,500 and 39,800 points in coming days. It’s recommended to trade very cautiously during current trading session and it would be preferred to remain in selling on strength.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.