Previous Session Recap

Trading volume at PSX floor dropped by 2.51 million shares or 1.67%, DoD basis, whereas, the benchmark KSE100 Index opened at 40494.58, posted a day high of 41334.93 and a day low of 40494.58 during the last trading session. The session suspended at 41312.59 with a net change of 844.10 points and net trading volume of 81.77 million shares. Daily trading volume of KSE100 listed companies dropped by 1.32 million shares or 1.59%, DoD basis.

Foreign Investors remained in net selling position of 12.54 million shares and net value of Foreign Inflow dropped by 11 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in a net selling position of 11.58 and 0.98 million shares. While on the other side Local Individuals, Banks and NBFCs remained in net selling position of 1.31, 1.41 and 0.15 million shares respectively, but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying position of 2.38, 5.96, 6.6 and 0.33 million shares respectively. Foreign investors have offloaded 22.16 million shares from their holding which worth 9.76 million US Dollars on month till date basis.

Analytical Review

Chinese shares climbed on Monday after a week-long break as a disappointing survey on the country’s service sector did little to dent optimism on global growth, while political uncertainty caused turbulence for the Turkish and British currencies. Liquidity was lacking with Japan and South Korea on holiday and a partial holiday in the United States where stocks will be open but bonds will be closed. The Chinese blue-chip CSI300 index rose 1.9 percent to heights not seen since late 2015, partly in a delayed reaction to a targeted easing by the country’s central bank announced a week ago. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.1 percent, having rebounded by 1.7 percent last week. E-Mini futures for the S&P 500 were trading 0.15 percent firmer, while futures for the Treasury 10-year note rose 1 tick.

Pakistan’s top tax machinery is delaying honoring its international commitments to prevent tax evasion and the setting up of offshore accounts for stashing ill-gotten wealth. The Organisation of Economic Cooperation and Development (OECD) has warned Pakistan that it may lose the right to receive information on a reciprocal basis from other 104 signatories if its implementation of the required measures has deficiencies. In September 2016, Pakistan signed the Convention on Mutual Administrative Assistance in Tax Matters, which paved the way for the exchange of information regarding offshore accounts. The need for signing the convention arose in the wake of the Panama Papers case. One of the major conditions for the implementation of the convention was the setting up of six automatic exchanges of information (AEOI) zones across the country.

Pakistan National Shipping Corporation (PNSC) is looking to enter the marine services business, official sources told Dawn on Saturday. The national flag carrier has bid for two 75-tonne bollard pull tugs and two pilot boats that Karachi Port Trust (KPT) requires on chartering and hiring bases for a three-year period. PNSC currently has 19 subsidiaries that run different entities owned by the holding company. Nine of these subsidiaries are directly related to the shipping business, the sources said. The corporation has nine vessels, including four oil tankers and five bulk carries. Each vessel is being looked after by a subsidiary of PNSC.

The country’s wheat stocks have swelled to a record nine million plus tonnes. As per flour millers’ data, substantial wheat stocks have accumulated due to carryover stocks of previous years. Wheat consumption in Pakistan stands at 23m tonnes per annum. Pakistan has been reaping bumper wheat crop — between 25-26m tonnes — for the last two years. However, this huge stock now appears to be a liability keeping in view consumption and unfeasible export potential.

The logo and pump design of Euro Oil, a new oil marketing company venturing into Pakistan market, was unveiled in a graceful event held at a local hotel. The company announced to open 300 retail stations in Pakistan over the next three years and also to open up stand-alone lubricant stations in collaboration with Gazprom, one of the world’s largest oil companies. The event was attended by Habib Ahmad, Honorary Consul General of Russian Federation, renowned analyst Mujibur Rahman Shami, Chairman Euro Oil Adnan Nasir, Chief Executive Umer Shami and Chief Operating Officer Sohail Ahmad. A number of other senior company management and dealers and retailers from all across Pakistan also attended the ceremony. Sohail Ahmad, while addressing the ceremony, elaborated on the future plans of the company and informed the audience of foreign investment Euro Oil is bringing to the Pakistan oil industry. He said that Euro Oil will introduce new standards of customer service and quality in the market and will invest aggressively to achieve the target of 300 fuel stations in next three years.

Today ATRL, ISL, NML, NRL and TRG may lead the market in the positive direction.

Technical Analysis

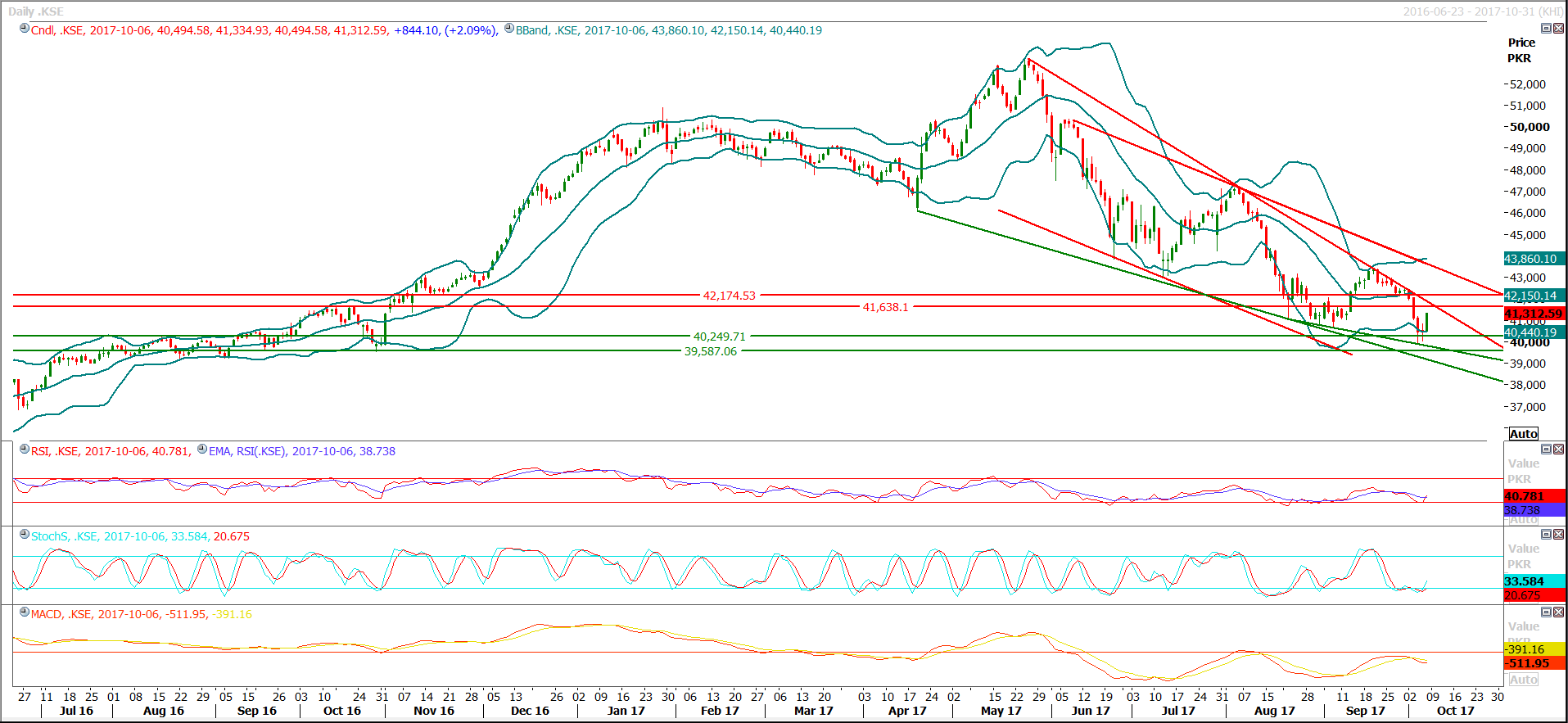

The Benchmark KSE100 Index has formatted a morning star on the daily chart and has bounced back after getting support from a supportive trend line. Daily Stochastic along with MAORSI also have generated a bullish crossover which might try to push index in positive zone but index has resistances ahead at 41700 and 42200 which might become hurdles for bullish momentum. Index may also complete its 50% and 61.8% daily bearish corrections at 41700 and 42170 and these both levels fall on resistant regions. For the current trading session index might try to remain slightly bullish but this momentum would be expired if index fails to close above 42200, therefore a cautious trading strategy is recommended in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.