Previous Session Recap

Trading volume at PSX floor dropped by 16.63 million shares or 5.69% on DoD basis, whereas the benchmark KSE100 index opened at 36,765.56, posted a day high of 37,289.41 and a day low of 36,481.03 points during last trading session while session suspended at 37,166.96 points with net change of 401.40 points and net trading volume of 174.66 million shares. Daily trading volume of KSE100 listed companies dropped by 14.54 million shares or 7.69% on DoD basis.

Foreign Investors remained in net buying positions of 2.66 million shares and net value of Foreign Inflow increased by 1.80 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis Investors remained in net buying positions of 0.006, 0.08 and 2.57 million shares. While on the other side Local Individuals, Companies, Banks and Insurance Companies remained in net selling positions of 9.56, 0.96, 15.65 and 3.76 million shares but NBFCs, Mutual Funds and Brokers remained in net buying positions of 0.23, 21.58 and 5.44 million shares respectively.

Analytical Review

Stocks in cautious ranges ahead of China data, trade talk hopes fade

Asian stocks clung to tight ranges on Thursday as investors awaited key Chinese data for clues on how much the 16-month trade war between Beijing and Washington has hit growth in the world’s second-largest economy. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.01%. Australian shares were up 0.12%, while Japan’s Nikkei stock index fell 0.02%. Dashing previously upbeat expectations about a resolution to the Sino-U.S. trade war was a Wall Street Journal report that said negotiations had hit a snag over farm purchases. Worries about violent anti-government protests in Hong Kong also soured investor sentiment. In the cautious climate, the yen and the Swiss franc, two currencies considered safe-havens, held onto gains against the dollar. Investors are trying to determine whether the stimulus measures the Chinese government has taken so far are helping prevent further economic slowdown. However, complete confidence in the global outlook is unlikely to return until there is a lasting solution to the U.S.-China trade war.

Tax regime to be reformed with stakeholders’ consent: PM

Prime Minister Imran on Wednesday held out an assurance to top officials of the Federal Board of Revenue (FBR) that the tax machinery would be reformed in consultation with all stakeholders not only to restore confidence of taxpayers but also to raise potential revenue from all sectors. Almost a week after resistance from tax officers over the proposed reforms, the prime minister called senior tax officers of BS-21 and above for a meeting to take them on board for implementation of his tax reforms agenda. The prime minister’s meeting with the tax officers was postponed thrice earlier. Speaking during Wednesday’s meeting, Mr Khan reminded the tax officers of their role in the country’s economic stability and asked them to give feedback on tax reforms.

Wheat support price increased to Rs1,350

The Economic Coordination Committee (ECC), in a meeting chaired by Finance Adviser Hafeez Shaikh on Wednesday, increased minimum support price for wheat by Rs50 to Rs1,350 in order to safeguard growers’ interests. The increase comes after a gap of five years, as the government last raised wheat support prices by Rs100 to Rs1,300 for 40kg bags back in 2014. Although, the move will benefit local wheat growers, it is expected to push up prices of rotis which have already increased two times in the last twelve months owing to rising flour and gas prices. However, a Ministry of Food Security official claimed the new minimum support price would not translate in any increase in the price of rotis. He said the minimum price will help farmers cover rising input costs.

$250m World Bank loan to help improve human capital

The World Bank is considering providing a loan of $250 million to Pakistan to strengthen the civil registration and vital statistics (CRVS), health and education systems essential for human capital accumulation, and improving the contribution of women and girls to economic productivity, and federal safety nets to respond to shocks in a more efficient manner. According to the World Bank, the proposed operation is the first in a series of two Development Policy Credit (DPC) operations for the project known as ‘Securing Human Investments to Foster Transformation (Shift). The project is being prepared as part of a package including the resilient institutions for sustainable economy, aimed at supporting medium-term structural reforms over the next three years focusing on fiscal management, growth and competitiveness, and human capital outcomes for productivity gains. Currently, Pakistan is not investing enough in its people to accelerate better human capital outcomes, and the country scores low in the World Bank Human Capital Index. As the index is directly linked to productivity, if no changes in human capital accumulation take place, a Pakistani child born today is expected to be only 40 per cent as productive as he or she would be when turning the age of 18.

ECC enhances minimum support price of wheat by Rs50 per 40kg

The Economic Coordination Committee (ECC) of the Cabinet has increased the minimum support price of wheat by Rs50 per 40 kg. It also okayed a plan to control the soaring circular debt of power sector. The ECC has approved a detailed proposal based on a comprehensive four-year Circular Debt Capping Plan presented by the Power Division to address the flow of the circular debt through effective efficiency improvement measures and ensure an effective implementation of the National Electricity Policy 2019. Under the plan that mainly addresses sector inefficiencies, discrepancies in tariff regime, fiscal allocations and government policy measures, planning and debt servicing of Power Holding Private Limited Loans, measures would be taken to improve power distribution collection, 100% collection by five distribution companies, reduction in line losses, rationalisation of subsidy allocations, reduction of running and permanent defaulters and reducing power sector flows to less than Rs 75 billion per annum from the current level of Rs 465 billion per annum.

Asian stocks clung to tight ranges on Thursday as investors awaited key Chinese data for clues on how much the 16-month trade war between Beijing and Washington has hit growth in the world’s second-largest economy. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.01%. Australian shares were up 0.12%, while Japan’s Nikkei stock index fell 0.02%. Dashing previously upbeat expectations about a resolution to the Sino-U.S. trade war was a Wall Street Journal report that said negotiations had hit a snag over farm purchases. Worries about violent anti-government protests in Hong Kong also soured investor sentiment. In the cautious climate, the yen and the Swiss franc, two currencies considered safe-havens, held onto gains against the dollar. Investors are trying to determine whether the stimulus measures the Chinese government has taken so far are helping prevent further economic slowdown. However, complete confidence in the global outlook is unlikely to return until there is a lasting solution to the U.S.-China trade war.

Prime Minister Imran on Wednesday held out an assurance to top officials of the Federal Board of Revenue (FBR) that the tax machinery would be reformed in consultation with all stakeholders not only to restore confidence of taxpayers but also to raise potential revenue from all sectors. Almost a week after resistance from tax officers over the proposed reforms, the prime minister called senior tax officers of BS-21 and above for a meeting to take them on board for implementation of his tax reforms agenda. The prime minister’s meeting with the tax officers was postponed thrice earlier. Speaking during Wednesday’s meeting, Mr Khan reminded the tax officers of their role in the country’s economic stability and asked them to give feedback on tax reforms.

The Economic Coordination Committee (ECC), in a meeting chaired by Finance Adviser Hafeez Shaikh on Wednesday, increased minimum support price for wheat by Rs50 to Rs1,350 in order to safeguard growers’ interests. The increase comes after a gap of five years, as the government last raised wheat support prices by Rs100 to Rs1,300 for 40kg bags back in 2014. Although, the move will benefit local wheat growers, it is expected to push up prices of rotis which have already increased two times in the last twelve months owing to rising flour and gas prices. However, a Ministry of Food Security official claimed the new minimum support price would not translate in any increase in the price of rotis. He said the minimum price will help farmers cover rising input costs.

The World Bank is considering providing a loan of $250 million to Pakistan to strengthen the civil registration and vital statistics (CRVS), health and education systems essential for human capital accumulation, and improving the contribution of women and girls to economic productivity, and federal safety nets to respond to shocks in a more efficient manner. According to the World Bank, the proposed operation is the first in a series of two Development Policy Credit (DPC) operations for the project known as ‘Securing Human Investments to Foster Transformation (Shift). The project is being prepared as part of a package including the resilient institutions for sustainable economy, aimed at supporting medium-term structural reforms over the next three years focusing on fiscal management, growth and competitiveness, and human capital outcomes for productivity gains. Currently, Pakistan is not investing enough in its people to accelerate better human capital outcomes, and the country scores low in the World Bank Human Capital Index. As the index is directly linked to productivity, if no changes in human capital accumulation take place, a Pakistani child born today is expected to be only 40 per cent as productive as he or she would be when turning the age of 18.

The Economic Coordination Committee (ECC) of the Cabinet has increased the minimum support price of wheat by Rs50 per 40 kg. It also okayed a plan to control the soaring circular debt of power sector. The ECC has approved a detailed proposal based on a comprehensive four-year Circular Debt Capping Plan presented by the Power Division to address the flow of the circular debt through effective efficiency improvement measures and ensure an effective implementation of the National Electricity Policy 2019. Under the plan that mainly addresses sector inefficiencies, discrepancies in tariff regime, fiscal allocations and government policy measures, planning and debt servicing of Power Holding Private Limited Loans, measures would be taken to improve power distribution collection, 100% collection by five distribution companies, reduction in line losses, rationalisation of subsidy allocations, reduction of running and permanent defaulters and reducing power sector flows to less than Rs 75 billion per annum from the current level of Rs 465 billion per annum.

Market is expected to remain volatile during current trading session.

Technical Analysis

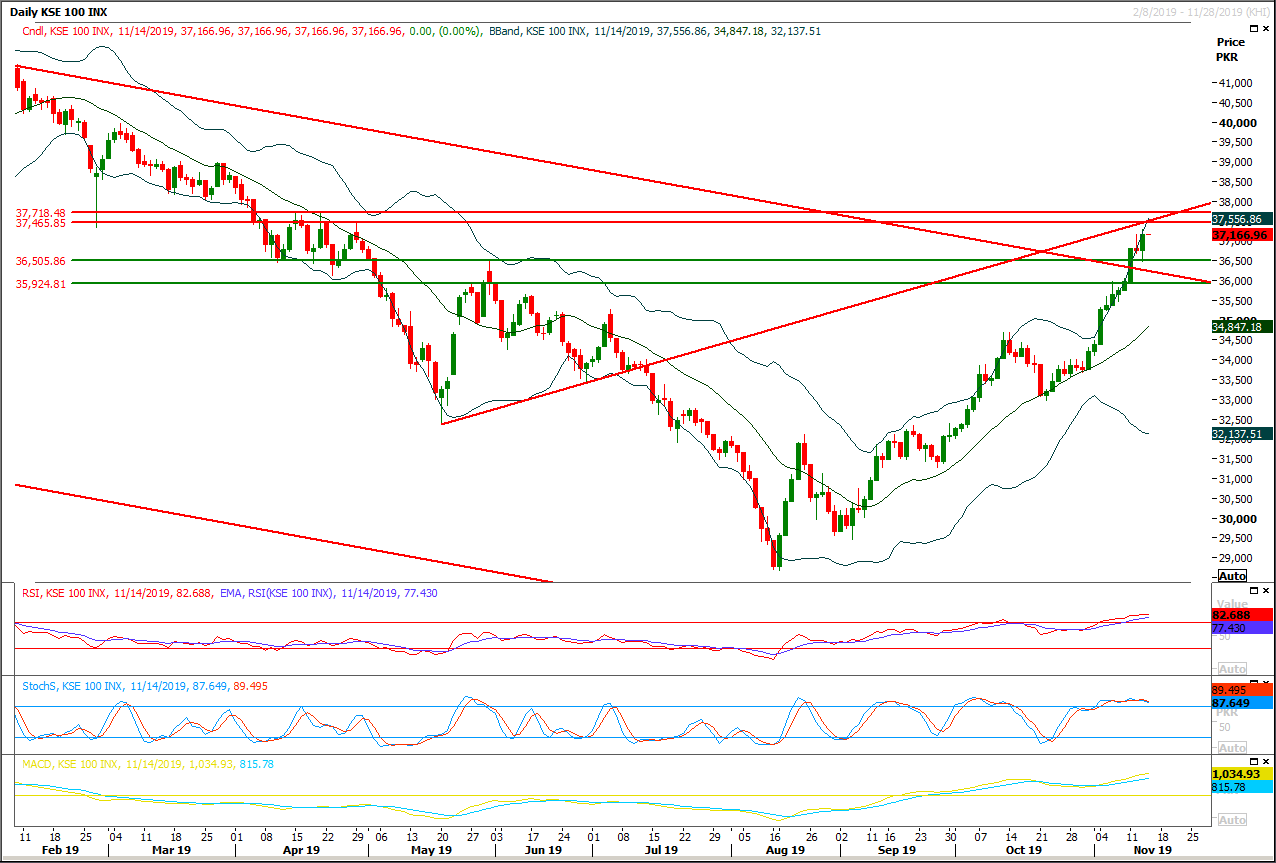

The Benchmark KSE100 index had dishonored a hammer on daily chart during last trading session after getting support from a horizontal supportive region and now it's now expected that index would face some pressure from 37,465 points and 37,700 points. While on flip side supportive regions are standing at 36,800 and 36,500 points. It's recommended to start selling on strength and short positions with strict stop loss of 37,800 points because on this region index would face strong resistances on monthly chart. While an ascending trend line is also posting a crossover with a horizontal resistant region at 36,465 points and this region would try to react as a strong resistance for index therefore it's recommended to stay cautious and post trailing stop loss on existing long positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.