Previous Session Recap

Trading volume at PSX floor dropped by 75.03 million shares or 25.83% on DoD basis, whereas the benchmark KSE100 index opened at 35,758.94, posted a day high of 35,758.94 and a day low of 33,618.90 points during last trading session while session suspended at 33,684.91 points with net change of -2375.97 points and net trading volume of 170.25 million shares. Daily trading volume of KSE100 listed companies also dropped by 67.44 million shares or 28.37% on DoD basis.

Foreign Investors remained in net long positions of 4.10 million shares but value of Foreign Inflow dropped by 0.91 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.02 and 5.15 million shares but Overseas Pakistani remained in net long positions of 9.26 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 15.66, 7.44, 0.33,8.74 and 8.12 million shares but Local Companies and Mutual Fund remained in net selling positions of 31.05 and 13.11 million shares respectively.

Analytical Review

Asian stocks fall in volatile session after historic Wall St. plunge

Asian shares fell on Tuesday in a topsy-turvy session following one of Wall Street’s biggest one-day routs in history as headlines about the coronavirus outbreak and its global economic impact whiplashed investor sentiment.Financial markets cratered on Monday with the S&P 500 .SPX tumbling 12%, its biggest drop since "Black Monday" three decades ago, as a series of emergency central bank rate cuts globally only added to the recent sense of investor panic.

IMF to mobilise $1tr to fight coronavirus

The International Monetary Fund (IMF) said on Monday it’s ready to use its $1 trillion lending capacity to help countries struggling with the humanitarian and economic impact of the novel coronavirus (COVID-19). On Sunday, the US Federal Reserve offered a massive monetary stimulus to encourage economic growth, by slashing interest rates to zero. It also launched a $700 billion quantitative easing programme to shelter the economy from the effects of the virus. “The IMF stands ready to mobilise its $1 trillion lending capacity to help our membership,” IMF managing director Kristalina Georgieva said in a statement. “As a first line of defence, the Fund can deploy its flexible and rapid-disbursing emergency response toolkit to help countries with urgent balance-of-payment needs.”

Panic buying hits select commodities

Panic buying in some markets has created shortage of key commodities like branded flour bags besides pushing up demand for items including pulses, ghee/cooking oil, sugar and rice by 20-30 per cent. Ashrafi fine flour bag have disappeared from the markets while stocks of Bake Parlour flour left in shops are hardly 20pc. Shopkeepers were seen insisting that buyers pick loose fine flour or chakki flour for themselves. Some retailers who have stocks of Bake Parlour brand made windfall by charging Rs310-350 per five kg bag as compared to Rs270-280 prior to the coronavirus outbreak in Pakistan. Similarly, the10kg bag of this brand is being sold for Rs600-620 as compared to Rs540-550 earlier.

Government scrambles for resources to meet virus-related expenses

As the government started looking out for grants and aid to fight threat caused by Coronavirus (Covid-19), the International Monetary Fund on Monday agreed not to consider expenditures to be made on deadly virus in deficit targets. Informed sources told Dawn that the government has contacted the relevant agencies of the United Nations and the World Bank for grants and assistance through quick disbursing windows for initial response to the disease and immediate relief. Simultaneously, the government was examining the option of approaching the International Monetary Fund (IMF) and the World Bank for larger loans from special funds made available by the two lending agencies for global fight against coronavirus.

SEZs to boost exports to $1.5 billion per annum

Special Economic Zones (SEZs) would help country enhancing export by $1 billion to $1.5 billion per annum in the short-run by ensuring effective and comprehensive planning. In a statement issued here on Sunday, Faisalabad Industrial Estate Development and Management Company (FIEDMC) Chief, Mian Kashif said FIEDMC a successful entity of combination of public private sectors partnership and first ever state of the art will ultimately turn into a economic engine of country progress through China Pakistan Economic Corridor initiatives. Appreciating economic vision of Prime Minister Imran Khan, he said Premier has directed all the concerned departments to remove hurdles in the way of development of SEZs and establish them on priority basis.

Asian shares fell on Tuesday in a topsy-turvy session following one of Wall Street’s biggest one-day routs in history as headlines about the coronavirus outbreak and its global economic impact whiplashed investor sentiment.Financial markets cratered on Monday with the S&P 500 .SPX tumbling 12%, its biggest drop since "Black Monday" three decades ago, as a series of emergency central bank rate cuts globally only added to the recent sense of investor panic.

The International Monetary Fund (IMF) said on Monday it’s ready to use its $1 trillion lending capacity to help countries struggling with the humanitarian and economic impact of the novel coronavirus (COVID-19). On Sunday, the US Federal Reserve offered a massive monetary stimulus to encourage economic growth, by slashing interest rates to zero. It also launched a $700 billion quantitative easing programme to shelter the economy from the effects of the virus. “The IMF stands ready to mobilise its $1 trillion lending capacity to help our membership,” IMF managing director Kristalina Georgieva said in a statement. “As a first line of defence, the Fund can deploy its flexible and rapid-disbursing emergency response toolkit to help countries with urgent balance-of-payment needs.”

Panic buying in some markets has created shortage of key commodities like branded flour bags besides pushing up demand for items including pulses, ghee/cooking oil, sugar and rice by 20-30 per cent. Ashrafi fine flour bag have disappeared from the markets while stocks of Bake Parlour flour left in shops are hardly 20pc. Shopkeepers were seen insisting that buyers pick loose fine flour or chakki flour for themselves. Some retailers who have stocks of Bake Parlour brand made windfall by charging Rs310-350 per five kg bag as compared to Rs270-280 prior to the coronavirus outbreak in Pakistan. Similarly, the10kg bag of this brand is being sold for Rs600-620 as compared to Rs540-550 earlier.

As the government started looking out for grants and aid to fight threat caused by Coronavirus (Covid-19), the International Monetary Fund on Monday agreed not to consider expenditures to be made on deadly virus in deficit targets. Informed sources told Dawn that the government has contacted the relevant agencies of the United Nations and the World Bank for grants and assistance through quick disbursing windows for initial response to the disease and immediate relief. Simultaneously, the government was examining the option of approaching the International Monetary Fund (IMF) and the World Bank for larger loans from special funds made available by the two lending agencies for global fight against coronavirus.

Special Economic Zones (SEZs) would help country enhancing export by $1 billion to $1.5 billion per annum in the short-run by ensuring effective and comprehensive planning. In a statement issued here on Sunday, Faisalabad Industrial Estate Development and Management Company (FIEDMC) Chief, Mian Kashif said FIEDMC a successful entity of combination of public private sectors partnership and first ever state of the art will ultimately turn into a economic engine of country progress through China Pakistan Economic Corridor initiatives. Appreciating economic vision of Prime Minister Imran Khan, he said Premier has directed all the concerned departments to remove hurdles in the way of development of SEZs and establish them on priority basis.

Market is expected to remain volatile during current trading session.

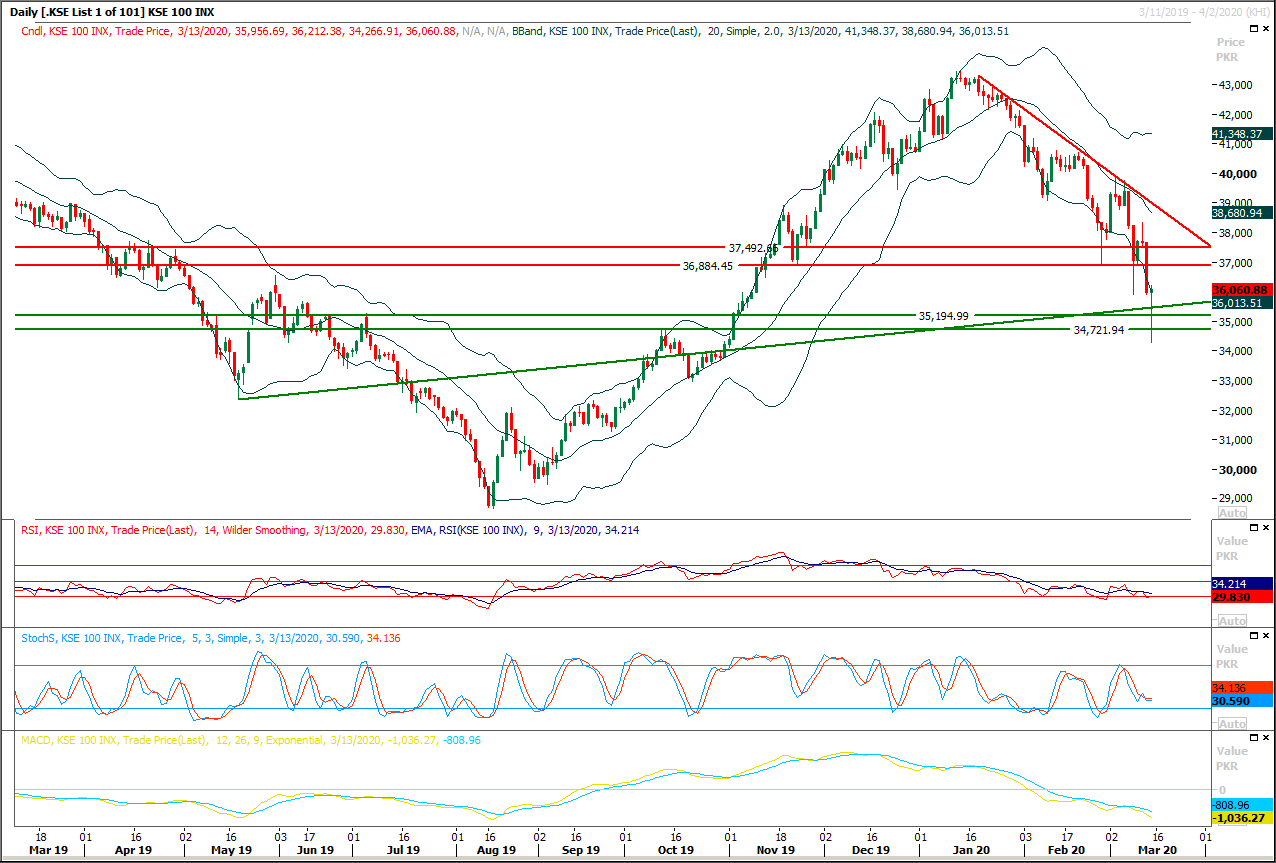

Technical Analysis

The Benchmark KSE100 index have bounced back after completing 100% expansion of its last correction and getting support from a horizontal supportive region and now it's expected that index would face strong resistances at 36,880 and 37,500 points. As of now it's expected that index would start a new bearish journey after an intraday spike and during this intraday pull back index would face resistances at 36,500 and 36,880 points. It's recommended to start profit taking from existing long positions and start selling on strength with strict stop loss of 37,500 points. Meanwhile if index would succeed in sliding below 35,700 points on hourly closing basis then some serious pressure could be witnessed during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.