Previous Session Recap

The Bench Mark KSE100 Index Opened at 49756.77, posted day high of 50286.02 and day low of 49668.64 points during last trading session while session suspended at 50192.36 points with net change of 435.59 points and net trading volume of 202.81 million shares. Daily trading volume of KSE100 listed companies increased by 30.15 million shares or 17.46% on DOD bases.

Analytical Review

Asian shares were steady on Friday in holiday-thinned trade and were on track for a solid advance this week, while oil and the dollar retained gains in the wake of strong U.S. corporate earnings. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed with several markets closed for the Lunar New Year holiday. It is on track to end the week up 1.9 percent. Japanese Nikkei .N225 rose 0.4 percent, extending gains for the week to 1.8 percent. Chinese, Taiwan, Vietnam and South Korea are shut for the Lunar New Year holiday. China will resume trade on Friday, Feb. 3; Taiwan and Vietnam on Thursday, Feb. 2, and Korea on Tuesday, Jan. 31. Overnight on Wall Street, all three major indices hit life-time intraday highs, with the Dow Jones Industrial Average .DJI rising 0.2 percent to also set a record close after breaching 20,000 on Wednesday. The S&P 500 .SPX and the Nasdaq .IXIC inched back down to end the day a touch below Wednesday record close.

The National Electric Power Regulatory Authority (Nepra) on Thursday cut electricity tariff by 2.21 per unit for all distribution companies except for privatised K-Electric that was provisionally allowed to charge about 40 paisas per unit more from its consumers. The tariff adjustments were allowed after public hearings under monthly fuel adjustment that required transfer of actual fuel cost of power generation to consumers. The change in electricity rates would not be applicable to agricultural consumers and residential consumers with less than 300 units of monthly consumption. The public hearing once again brought to limelight the inability of the two major power projects — Nandipur and Guddu Power — to positively contribute to the national energy supply on a sustainable basis because of their problematic operations.

Disappointed with the silence of Ministry of Water and Power, National Transmission and Despatch Company (NTDC) has sought help from National Electric Power Regulatory Authority (Nepra) to bring an end to supply of 650 MW electricity to Karachi Electric (KE) from the national grid, without any agreement. This interesting situation was witnessed at a public hearing on Thursday in the matter of provisional monthly Fuel Charge Adjustment (FCA) in Nepra presided over by Vice Chairman Hamayat Ali Khan.

National Electric Power Regulatory Authority (Nepra) has been accused of overburdening KE consumers, forcing them to pay an additional Rs 62 billion. Well-informed sources in Nepra told Business Recorder that these revelations have been made in a letter written by Secretary Water and Power, Younus Dagha to Chairman Nepra, Brigadier Tariq Saddozai (retired).

The National Assembly’s Standing Committee on Finance on Thursday approved Companies Bill 2016 after a heated debate. Key committee members belonging to the PML-N, including chairman Qaiser Ahmed Sheikh, asked officials technical questions that left them speechless. They criticised the Securities and Exchange Commission of Pakistan (SECP) for not taking the recommendations of the NA body seriously. Companies Bill 2016 became controversial after the government promulgated it as an ordinance. However, a resolution in the Senate abolished it.

TRG, ANL, HUBC and SEARL can lead market in positive direction.

Technical Analysis

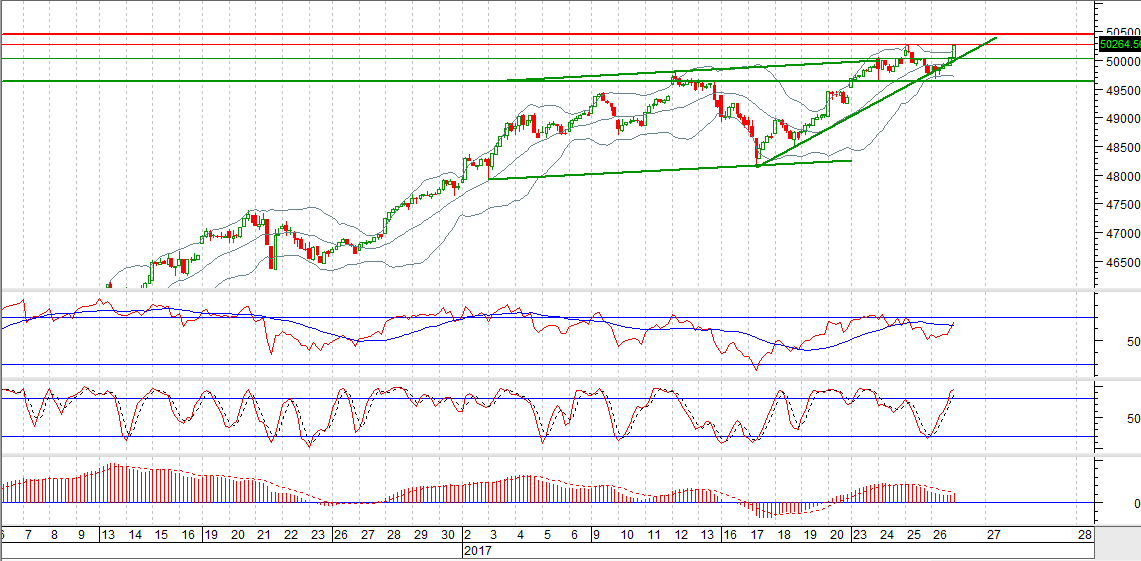

The Benchmark KSE100 Index have closed above a major barrier of 50000 during last trading session by posting day high of 50286.02 and closing at 50192.36. Its getting resistance from 61.8% expansion of its hourly correction. It has penetrated its supportive trend line in downward direction but it is being supported by a horizontal support which will provide a supportive breath around 5034 which will try to push index back in positive zone but closing below that region can call for 49660 points. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.