Previous Session Recap

Trading volume at PSX floor increase by 31.00 million shares or 41.33%, DoD basis, whereas, the benchmark KSE100 Index opened at 41120.12, posted a day high of 41262.45 and a day low of 41003.05 during the last trading session. The session suspended at 41049.22 with a net change of -70.90 points and net trading volume of 106 million shares.

Foreign Investors remained in a net selling position of 1.11 million shares and net value of Foreign Inflow increased by 0.61 million US Dollars. Categorically, Foreign Corporate Investors and Overseas Pakistanis remained in a net selling position of 0.424 and 0.688 million shares .While on the other side Local Individuals, Local Companies and Brokers remained in net selling positions of 4.13, 0.21 and 2.71 million shares but, Banks, Mutual Funds and NBFC's remained in net buying positions of 0.95, 3.92 and 0.08 million shares respectively.

Analytical Review

Asian stocks were mixed as a rally that lifted regional equities to the highest levels in at least a decade stalled. The dollar came under pressure after advancing against G10 peers amid concern about the progress of U.S. tax reforms. Japan’s Nikkei 225 Stock Average fell after rallying to close to its strongest level since January 1992 on Tuesday, buoyed by corporate earnings and a weakening yen. Stocks climbed in Hong Kong, where e-book publisher China Literature Ltd.

President Mamnoon Hussain on Tuesday said China had emerged as a major investor and partner for Pakistan with great prospects of materializing the possibilities of development in both countries. Addressing the inauguration ceremony of launch of Bank of China’s operations in Pakistan, the President said it would become a source of taking this historic friendship to new heights by strengthening the already existing deep relations between the two "iron brothers". The President said the launch of Bank of China was a memorable event in the everlasting friendship between Pakistan and China which was also a manifestation of this historical fact that the shared dream of two countries would soon be realized. He said in the context of business environment in Pakistan, the opening of Bank of China indicated that the benefits of China-Pakistan Economic Corridor (CPEC) would soon start reaching the masses.

The Federal Board of Revenue (FBR) will examine the Paradise Papers to seek information from Pakistani nationals about ownership of offshore companies and details about their tax matters, etc. Sources told Business Recorder here on Tuesday that so far the FBR has not designated Directorate General of Intelligence and Investigation Inland Revenue (IR) as the competent agency to investigate the matter. The list of names in Paradise papers is extensive and needs some time to be fully examined by investigators of the FBR. The FBR will examine names of Pakistani nationals appearing in the Paradise Papers. Once the list has been properly securitized, tax authorities would designate one of its departments to issue notices to the owners of offshore companies under relevant provisions of the Income Tax Ordinance 2001.

Fertilizer manufacturers of Pakistan have forecast a surplus urea inventory in the country which will be enough to meet the local demand over the next six months (October 2017 to March 2018). According to the Fertilizer Manufacturers Pakistan Advisory Council (FMPAC), the inventory position during the year had swelled up to a level that the government allowed export of 600,000 tons. The NFML was unable to sell the imported urea bought at very high price and the ECC had to allow them to throw it away at Rs 1000 per bag with a loss of over 600 rupees per bag.

Bank of Punjab (BoP) will decide next month if it will make provisions for its longstanding bad debt disbursed prior to 2008 by using the cash it has raised through the issue of right shares worth Rs13 billion. Bank executives told Dawn that the management plans to use at least Rs6bn to make provisions against losses to retire the two letters of comfort issued by the Punjab government, which controls over 57pc stakes in the bank, to the State Bank of Pakistan for relaxing its provisioning criteria under prudential regulations.

Today ISL , PNSC and SSGC may lead the market in the positive direction.

Technical Analysis

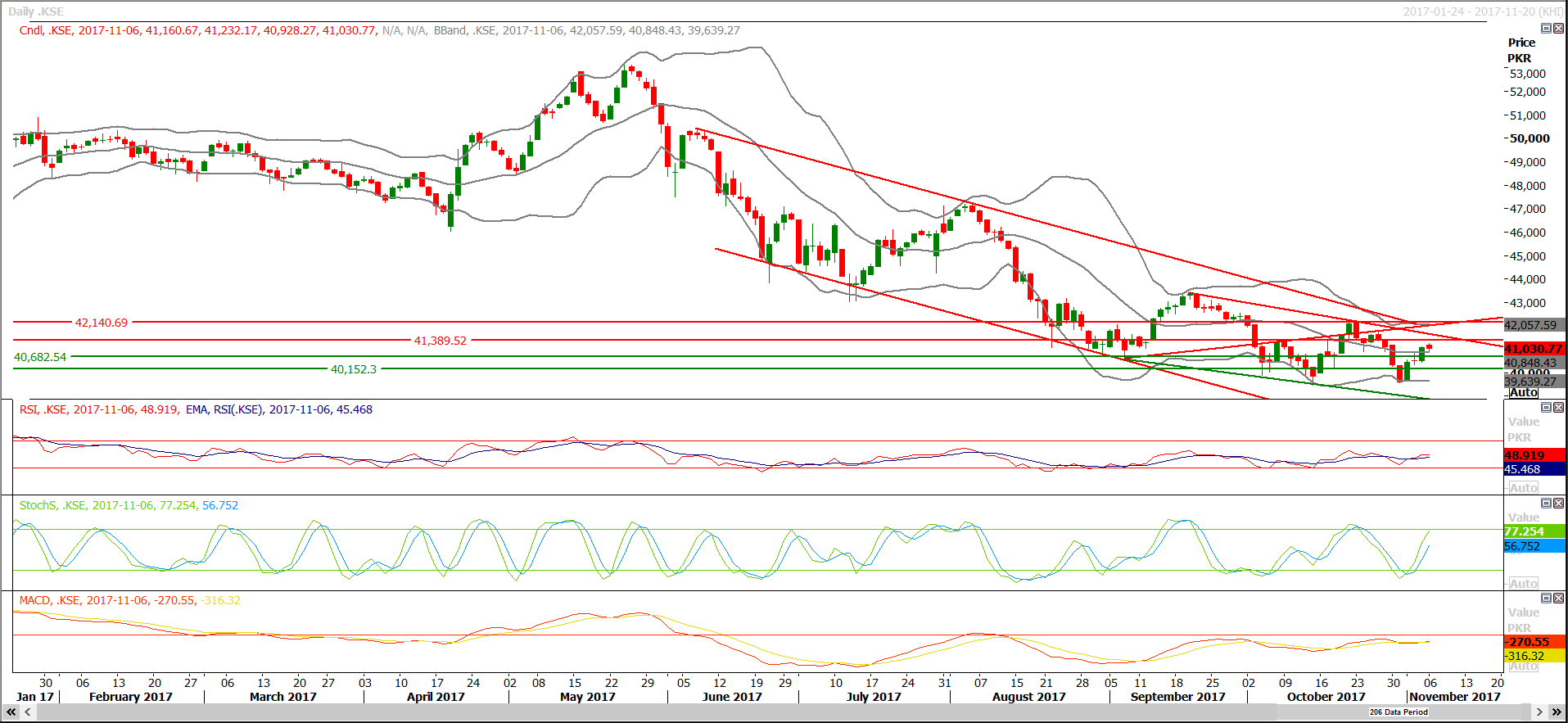

The Benchmark KSE100 Index has penetrated its major resistant region of 40900 in bullish direction and right now it is in short term momentum has been changed to positive, it also have maintained the same region as support during last trading session. As of now Index has resistance at 41400 while supportive regions are standing at 40660 and 40150. Index may complete 61.8% correction of its last bearish rally at 41170 therefore it is recommended to buy on dips and sell on strength for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.